Its no secret that when you seek trustworthy information on which to base your business and investment strategy, traditional and internal data sources, such as quarterly earnings reports, are no longer enough. This is especially the case when it comes to the financial services world. These stalwarts of a previous era cant keep up with the current 24/7 business cycle that demands real-time actionable insights. This is where alternative or external data sources come into play. They allow companies to utilize online data from a variety of sources that are only limited by one single factor: the organizations creativity to integrate them.

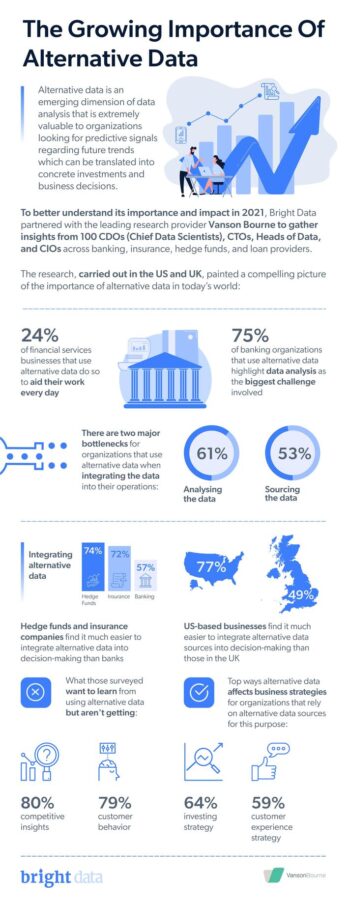

Alternative data is not quite living up to its name anymore it has hit the mainstream. New survey data weve commissioned with Vanson Bourne supports this, with 24 percent of financial services professionals using alternative data every day. These organizations have recognized that external information sources are too vital to neglect when building an agile, comprehensive, and winning business or investment strategy. The certainty that they provide is just too undeniable to ignore.

Its not all smooth sailing

Using alternative data sources is always going to be a subjective endeavor tailored to the specific needs of that organization or business; there is no right or wrong path. Whether its looking at a prospective investment, measuring growth by monitoring employee counts on LinkedIn, or tracking trade shipments to predict which way revenue is heading, relying on online data or any external data is no longer a nice-to-have element but a business or market necessity.

These data sources can help lead you to many potential investment routes or to verify whether your current routes will actually produce the desired results. The past year has made this growing realization a well-known fact. The aforementioned study illustrates it with 80 percent of those surveyed expressing that they require more competitive insights from alternative data, and 79 percent hoping to get information on customer behavior from the data.

When the need is so obviously stated, what are the challenges stopping it from being widely incorporated into all organizations? Lets start with the fact that theres no single playbook on how to gain actionable insights from these data sources in the most effective way. With 61 percent of financial services professionals citing data analysis as a major bottleneck for integrating the data into operations, this is clearly indicating an operational challenge to overcome.

This challenge is also felt across related industries. Three-quarters of banking professionals surveyed felt that data analysis was the biggest challenge they faced when it came to alternative data. Meanwhile, hedge funds and insurance company employees found it less challenging on average and are gaining the required insights on the go.

What generates this gap in the need for alternative data consumption and the actual integration and utilization? The reasons lie within the organizations readiness as well as assigned professional resources to look after the entire data sourcing process. In addition, the source of the challenge often goes back to a strict compliance process and demands that inhibit the inclusion of alternative data.

When it comes to insurance companies and hedge funds, the business cases are clearly defined. In the insurance industry, this could mean integrating alternative data such as crime reports in a target area into the calculations used to set rates. For hedge funds, it could be using the real-time data to make on-the-spot trading decisions on a frequent basis.

Banks and banking services are known for their more traditional approach and security concerns. However, there are multiple ways alternative data can directly and successfully serve banks growing business cases. For example, banks could use alternative data to determine how to market products in different regions or to decide what products to develop to begin with. However, these require a bit more ingenuity when it comes to seeking out data sources and gaining meaningful insights from them.

Traditional banks also tend to be much slower at adopting new technology than some of their financial services counterparts; they require a more sensitive touch to their overall compliance needs needs that can be met with the right kind of ethical data provider. Its therefore likely that their process for integrating the technology and talent needed to get the best insights is a more intensive and less agile process than it would be at a hedge fund.

What all of this means is that theres still a massive opportunity for financial services firms to leverage alternative data more effectively. And those that put the resources behind doing it well, will undoubtedly gain a more profound competitive advantage.

It all comes down to strategy and sensitive understanding

Alternative data purely works for the benefit of all financial markets this fact has been established. It often removes the guesswork from immediate decision-making, which should be the goal of any data initiative. Relying on outdated data or wrong data is frankly a recipe for disaster. This is what has led 64 percent of organizations that use alternative data to leverage it for investing decisions and 59 percent to use it to inform customer service strategies.

In the end, it all boils down to whether you have the following: the right, trustworthy operation that is sensitive to your security requirements, the professional talent to support your competitive strategy with data-driven creativity, and, last but not least, the ability to translate that huge amount of data into winning results! Whether you are a small organization starting out on your data-driven path or a large global bank, your data must set you apart from and ahead of all others.

I