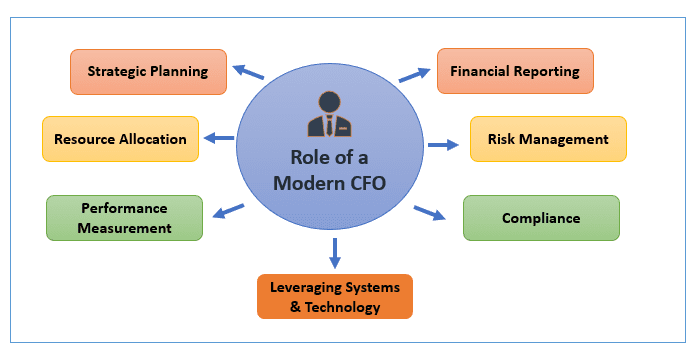

The role of a Chief Financial Officer (CFO) has always been of paramount importance for businesses small and large. They not only act as the backbone of an organization’s financial health and strategy but are also responsible for managing financial risks, overseeing the accuracy of financial reporting, and ensuring compliance with regulatory requirements. However, in today’s dynamic business environment, the role has significantly evolved, becoming more complex and strategic.

This involves:

Strategic Planning: Collaborating with other executives to develop long-term business strategies that align with financial goals.

Resource Allocation: Ensuring that resources are allocated efficiently to maximize return on investment and support strategic initiatives.

Performance Measurement: Utilizing key performance indicators (KPIs) and financial metrics to assess and drive organizational performance.

Financial Reporting: Ensuring that all financial statements are accurate, transparent, and compliant with regulatory standards. This builds trust with investors, stakeholders, and regulatory bodies.

Risk Management: Identifying and mitigating financial risks through robust risk management practices. This includes market risks, credit risks, and operational risks.

Compliance: Staying abreast of changes in financial regulations and ensuring the company’s practices adhere to these regulations to avoid legal penalties and maintain a good corporate reputation.

In addition to these responsibilities, a modern CFO’s expanded responsibility involves predicting future trends, leading growth efforts, and offering pivotal insights that influence the company’s strategic pursuits. To meet these demands, CFOs must embrace technology and innovation, which are now indispensable to current business landscape. Leveraging technology is vital for optimizing financial processes and decision-making.

Advanced analytics and business intelligence tools like Power BI empower CFOs to significantly enhance financial reporting by providing a comprehensive suite of tools that streamline data integration, visualization, and analysis. These robust capabilities transform raw data into actionable insights, enabling CFOs to identify trends and patterns effectively.

Leveraging technology is essential to enhance financial processes and decision-making. With the advent of business intelligence and data analytics tools like Power BI, CFOs can significantly enhance financial reporting by offering a comprehensive suite of tools and features that streamline data integration, visualization, and analysis. It offers robust capabilities that transform raw data into meaningful insights, helping CFOs identify trends and patterns.

Key Benefits of Power BI include:

Data Integration

Power BI can connect to a wide range of data sources, such as Excel spreadsheets, databases, cloud-based services, web APIs, ERP systems, accounting software, and external databases, allowing CFOs to consolidate financial data into a single, unified view. This integration helps in:

- Centralized Data Management: Bringing together disparate data sources for a holistic view of the company’s financial status.

- Automated Data Refresh: Ensuring that financial reports are always up to date with the latest data.

Data Modelling

Power BI’s data modeling capabilities allow shaping, and enhancing data by defining relationships, creating calculated columns and measures, and using the Power Query Editor for transformations. This ensures your financial reports are reliable and consistent, supporting better decision-making.

Enhanced Data Visualization

Power BI’s advanced data visualization capabilities transform complex financial data into intuitive and interactive charts, graphs, and dashboards. This helps in:

- Identifying Trends and Patterns: Visual representations like funnels, scatter charts and tree maps make it easier to spot trends, patterns, and anomalies.

- Customizable Dashboards: Tailoring dashboards to display key metrics and performance indicators relevant to specific stakeholders.

Interactive Reporting

Power BI enables the creation of interactive reports that allow users to drill down into data and explore specific details. This functionality supports:

- Detailed Analysis: Users can investigate underlying data to understand the drivers behind financial metrics.

- Ad-Hoc Queries: Allowing users to ask specific questions and get answers through dynamic data exploration.

Custom Calculations and Formulas

Financial reporting often demands specific formulas and calculations. Power BI’s Data Analysis Expressions (DAX) allows creation custom calculations and measures tailored to specific financial needs. Power BI provides flexibility to define these formulas for calculating profitability ratios, growth rates, and other financial metrics, ensuring precise and relevant financial analysis.

Real-Time Monitoring

With real-time data processing capabilities, Power BI allows CFOs to monitor financial performance continuously. This is crucial for:

- Proactive Management: Keeping an eye on KPIs and financial metrics in real-time to make timely and informed decisions.

- Alerting and Notifications: Setting up alerts to notify users of significant changes or anomalies in financial data.

Collaboration and Sharing

Power BI facilitates seamless collaboration among team members and stakeholders through:

- Shared Workspaces: Enabling multiple users to work together on financial reports and dashboards.

- Easy Sharing: Providing options to share reports and dashboards with colleagues, executives, and external stakeholders securely.

Advanced Analytics

Power BI includes advanced analytics features such as predictive analytics, machine learning, and AI-driven insights. These capabilities enhance financial reporting by:

- Forecasting: Using historical data to predict future financial trends and outcomes.

- Scenario Analysis: Testing various scenarios to understand potential impacts on financial performance.

Accessibility

Power BI is accessible on multiple devices, including desktops, tablets, and smartphones, allowing CFOs and other stakeholders to access financial reports anytime, anywhere. This feature supports:

- Mobile Access: Viewing and interacting with financial reports on the go.

- Remote Collaboration: Ensuring that remote teams can stay informed and collaborate effectively.

Security & Compliance

Security is paramount when handling sensitive financial data. Power BI provides robust security features to protect confidential information, maintain data integrity and comply with regulatory requirements. These features include:

- Data Protection and Access Control: Role-based access control (RBAC) and row-level security (RLS) ensure that only authorized users can access sensitive financial data. These features help to restrict data access based on user roles and permissions, protecting confidential information and maintaining data integrity.

- Compliance and Encryption: Power BI ensures compliance with regulatory requirements like GDPR, HIPAA, GAAP, and IFRS by offering encryption for data transmission and storage. Power BI allows tracking data lineage, recording data refreshes, and maintaining historical snapshots of datasets. By utilizing features like version control, data lineage visualization, and audit logs, Power BI helps ensure compliance with regulatory requirements and accounting standards by providing transparency into changes made to financial data over time.

Financial reporting is a cornerstone of effective financial management, providing insights crucial for decision-making and strategic planning. Power BI, offers numerous benefits for creating and analyzing financial statements, including profit & loss statements, cash flow statements, balance sheets, and financial ratios based on data from General Ledger.

Additionally, Power BI provides robust tools to analyze financial data across different periods such as quarters, years, and months. This temporal analysis is essential for identifying trends, comparing performance, and making informed business decisions. DAX includes time intelligence functions that allow create calculations across different time periods easily. Examples include TOTALYTD, SAMEPERIODLASTYEAR, and DATESYTD. These functions help compute year-to-date, quarter-to-date, month-over-month growth, and other time-based calculations.

Income Statement

An income statement shows a company’s revenues, expenses, and profits over a specific period. To create an income statement in Power BI, ensure your financial data is structured with the necessary columns:

- Date: The date of each transaction.

- Account Type: Categorization such as Revenue, Expense, or Profit.

- Account Name: The name of each account.

- Amount: The monetary value of each transaction.

Once the data is imported and transformed, the next step is to create relationships if the data is split across multiple tables. Use the Model view to establish relationships by dragging and dropping fields between tables. Ensure data types are correct. The next step involves creating necessary measures including for Total Revenue, Total COGS, Total Gross Profit, Gross Profit %, Total Other Expenses, Total Net Profit, and Net Profit %. Power BI also allows for comparison runs, say current year vs last year, Q2 vs Q1.

In order to create a visualization representing the Income statement, go to the Report view.

- Use a Matrix visual to display detailed revenues and expenses.

- Use Cards to display Total Revenue, Total COGS, and Net Profit.

- Use a Line chart to visualize revenue, expenses, and profit trends over time.

Format the visuals for clarity and visual appeal. Adjust colors, fonts, and data labels using the Visualizations pane.

Similarly, Income statements can be created for next year, next quarter, or next month.

Balance Sheet

A balance sheet is a statement that shows a company’s assets, liabilities and its equity at any given point in time.

Before importing your data into Power BI, ensure it is structured correctly. A typical balance sheet requires the following columns:

- Account Type: This categorizes each account as an Asset, Liability, or Equity.

- Account Name: This provides the name of each account.

- Amount: This indicates the monetary value associated with each account.

- Date: This helps track balance sheet changes over time (optional but recommended for dynamic analysis).

Once the data is imported, and transformed, the next step is to create relationships if the data is split across multiple tables. Use the Model view to establish relationships by dragging and dropping fields between tables. Ensure data types are correct, with numerical values for amounts and text for account names. Following modeling, creating measures in Power BI that allow for the calculation of key financial metrics using Data Analysis Expressions (DAX) for Total current assets, Total fixed assets, Total other assets, Total assets, Total current liabilities, Total long-term liabilities, and Total owner’s equity. Create a balance check measure to ensure the balance sheet is balanced. For visualization purposes, go to the Report view

- Use a Matrix visual to display the detailed breakdown of accounts under Assets, Liabilities, and Equity.

- Use Cards to display Total Assets, Total Liabilities, and Total Equity.

Format the visuals for clarity and visual appeal by adjusting colors, fonts, data labels, and other elements using the options in the Visualizations pane

Cashflow Statement

A cash flow statement tracks the flow of cash in and out of a business, segmented into operating, investing, and financing activities.

In order to create a cashflow statement, we need to ensure the financial data is well-structured with the following columns:

- Transaction Date: The date of each cash flow transaction.

- Transaction Type: Categorization such as Operating, Investing, or Financing activities.

- Description: A brief description of the transaction.

- Amount: The cash flow amount for each transaction.

Once the data is imported, and transformed, the next step is to create relationships if the data is split across multiple tables. Use the Model view to establish relationships by dragging and dropping fields between tables. Ensure data types are correct, to ensure dates, texts, and numerical values are properly formatted. The next step is to create measures for the calculation of Cash receipt from operations, Cash receipt from investing, Cash receipt from financing, Cash paid for operations, Cash paid for investing, Cash paid for financing, Total Operating Cash Flow, Total Investing Cash Flow, Total Financing Cash Flow, Net Cash Flow. To create a cash flow statement using the measures created, go to the Report view and create visualizations:

- Use a Matrix visual to display detailed cash flows under Operating, Investing, and Financing activities.

- Use Cards to display the Total Operating, Investing, and Financing Cash Flows, and Net Cash Flow.

- Use a Line chart to visualize cash flows over time.

In order to further enhance the interactivity of the reports, follow these steps:

Utilize Slicers: Incorporate slicers to enable users to filter the income statement by date or account type. This allows for more focused analysis and exploration of specific time periods or financial categories.

Implement Bookmarks and Buttons: Create bookmarks and buttons within your Power BI report for a more interactive user experience. These elements can be used to navigate between different views or scenarios of the financial statements, providing flexibility and control.

Ensure Data Refresh: Regularly update your data to ensure that the reports reflect the latest transactions and financial information. This ensures that users have access to up-to-date insights and analysis, enabling informed decision-making.

Financial Details – Ratio Analysis

Ratio analysis is a quantitative method of analyzing financial statements to assess a company’s performance and financial health. It involves calculating and interpreting various financial ratios from the data in income statements, balance sheets, and cash flow statements. These ratios provide insights into different aspects of a company’s operations, such as profitability, liquidity, efficiency, and solvency. By examining ratios over multiple periods, one can identify trends and potential issues, make informed decisions regarding operations, investments, and financing, and assess the viability and profitability of investments.

Some types of Financial Ratios include Liquidity Ratios, Profitability Ratios, and Solvency Ratios. Creating measures in Power BI allows you to calculate financial ratios.

Liquidity Ratios:

Current Ratio: Assesses a company’s ability to pay short-term obligations with its current assets. A good current ratio typically falls between 1.5 and 3.0

- (Current Assets / Current Liabilities)

Quick Ratio:

Evaluates the ability to meet short-term liabilities without relying on inventory sales.

- ((Current Assets – Inventory) / Current Liabilities)

Solvency Ratios:

Debt to Equity Ratio: Compares a company’s total liabilities to its shareholders’ equity

- (Total Liabilities / Equity)

Profitability Ratios:

Return on Assets (ROA): Shows how efficiently a company uses its assets to generate profit

- (Net Income / Total Assets)

Return on Equity (ROE): Reflects the return generated on shareholders’ equity

- (Net Income / Equity)

Gross Profit Margin: Gross profit margin is a financial metric that shows what percentage of a company’s revenue remains after subtracting the cost of goods sold (COGS). It indicates how efficiently a company is producing and selling its products.

- ((Revenue – Cost of Goods Sold) / Revenue)

Once the measures are created, go to the Report view and add visuals by using Card visuals to display the Current Ratio, Quick Ratio, Debt to Equity Ratio, Return on Assets, Return on Equity, and Gross Profit Margin.

Financial Forecasting

Power BI’s advanced analytics capabilities, including machine learning and predictive modeling, enable organizations to forecast future financial performance. By leveraging historical data and identifying key drivers of financial performance, Power BI can generate predictive insights that help organizations anticipate future trends, assess risks, and identify opportunities.

Power BI’s DAX (Data Analysis Expressions) language allows for the creation of custom calculations and measures tailored to specific forecasting needs. Whether calculating growth rates, profit margins, or cash flow projections, DAX enables precise and flexible financial modeling.

Power BI supports rolling forecasts, scenario analysis, and what-if modeling, allowing organizations to evaluate the potential impact of different strategic decisions. By adjusting assumptions and variables, users can simulate various financial scenarios and assess their implications.

Automation in Power BI streamlines the process of updating and maintaining forecasts. Automated data refreshes ensure that forecasts are based on the most current data, reducing the risk of outdated or inaccurate information.

Budgeting & Comparison Analysis

Power BI enables the creation of dynamic reports that that can significantly streamline the budgeting process, reducing cycle times, compare actual financial performance against budgeted figures. Such reports can highlight variances in revenue, expenses, and other key financial metrics, helping organizations understand how well they are adhering to their financial plans.

Power BI’s DAX (Data Analysis Expressions) language allows creation custom measures and calculations to analyze variances and performance across different scenarios.

- Actual vs. Budget: Calculate variances between actual and budgeted figures to assess performance.

- Actual vs. Forecast: Compare actual results with forecasts to evaluate the accuracy of predictions.

- Budget vs. Forecast: Analyze differences between budgeted figures and updated forecasts to identify potential adjustments.

Power BI also allows comparing financial performance across departments.

Comparative Analysis: Power BI enables comparison of financial performance across departments, allowing users to delve into departmental data and assess revenues, expenses, and other key metrics.

Cross-Departmental Insights: Power BI also helps create reports and dashboards that provide a clear, side-by-side comparison of financial performance between departments. This functionality aids in identifying trends, outliers, and areas for improvement, fostering informed decision-making and strategic planning.

Conclusion

Power BI significantly improves financial analysis through its advanced data modeling, dynamic visualization, and automation capabilities. Designing interactive dashboards in Power BI allows users to explore financial data dynamically, providing de s and facilitating informed decision-making. The automation of extracting, transforming, and loading (ETL) financial data into Power BI ensures data accuracy and timeliness, with scheduled data refreshes keeping reports current and eliminating manual entry errors.

Security and compliance are paramount when dealing with financial data. Power BI enables robust security measures, such as role-based access control (RBAC) and row-level security (RLS), to protect sensitive information. Encryption ensures data transmission and storage are secure, preventing unauthorized access. Additionally, maintaining an audit trail of changes to financial data helps comply with regulatory requirements like GDPR, HIPAA, GAAP, IFRS.

By incorporating these best practices, including setting up automated data refreshes to balance performance and resource usage, you can ensure that your financial reports in Power BI are accurate, secure, and compliant with relevant regulations. This comprehensive approach not only safeguards your financial data but also enhances the overall reliability and effectiveness of your financial analysis.

By leveraging advanced analytics, interactive dashboards, and customizable reports, CFOs can gain deeper insights into their organization’s financial health, identify trends, and make data-driven decisions that drive growth and profitability. Additionally, Power BI’s integration capabilities, security features, and compliance controls ensure that financial data remains secure, accurate, and compliant with regulatory standards.