Contributed by Ruonan Ding. She graduated from the NYC Data Science Academy 12 week full time Data Science Bootcamp program taking place between April 11th to July 1st, 2016. This post is based on her second class project – Shiny (due on the 4th week of the program). The original article can be found here.

The Shiny App can be found by clicking: http://shiny.markko.net/01work/

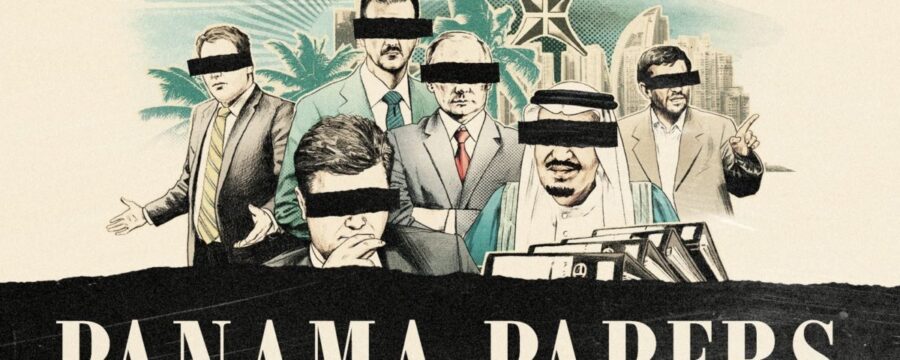

On May 9th, 2016, the International Consortium of Investigative Journalists released a searchable database with information on more than 200,000 offshore entities that are part of the Panama Papers investigation. The data comes from the Panamanian law firm, Mossack Fonseca, one of the top players in the offshore world, and includes information about companies, trusts, foundations and funds incorporated in 21 tax havens, from Hong Kong to Nevada in the United States. It links to people in more than 200 countries and territories.

The purpose of this App is to give the users the access to look at the geographic development of this secretive offshore world from 1975 to 2015. By definition, an offshore entity is that is incorporated in a low-tax jurisdiction. The company is not liable to taxation in its country of incorporation, it will be taxed in the country where it carries on its business. The two main purpose of having the offshore companies are first to have tax benefit and the other is to hide the final beneficial owners from this structure. Again, the purpose of this App is to unveil this offshore world. There are many complicated structures within itself and governed by different jurisdiction laws.

Where does the U.S. Money Go?

Let’s start with an example. U.S. has been a significant player in the world of all the offshore companies. That means these companies actually operate in the U.S. while having the jurisdiction somewhere off the shore. First let’s see where the money is from: the intermediaries, (law firms, banks, and accounting firms) facilitating the set up of the entities. The map below shows the participating middleman’s country. You can see most of the world countries actively participating. They move the money in or out of U.S. in this case.

And where the money goes in the end? the final jurisdiction is where the company is incorporated and need to fulfill the tax duties. As you can see on the graph, it’s very much concentrated in Central America and Europe, and some countries in SouthEast Asia.

Entities Distribution By Location

The next tab is show the geographic distribution of the offshore entities. It covers all the top countries with the most offshore entities. The table below gives you the exact statistics by country. As we can see, Hong Kong and Switzerland are the traditional offshore-onshore countries that offer not only low corporate tax but safety and good reputation for the entities.

Number of Entities Over Time

The number of offshore entities peaked at year 2005 till 2008 before the financial crisis. The graph below gives you the option of exploring the time wide development by different jurisdiction. The drop down selected the popular Central America jurisdictions.

Entities Status As of 2015

The entities status shows the purpose of having these entities. The majority of the entities are no longer active. 26% of the all entities are still available. That means most of them are not set up for the operational purpose. This could explain why people have the presumption that offshore entities are not a typical corporation. There are multiple purpose of establishing offshore entities.