Professional athletes know the importance of developing opposing or complementary muscles (quadriceps and hamstrings, biceps and triceps). These complementary muscles are sets of muscles that “work together” to move your body in the most efficient ways. If these muscles are strengthened together, it creates a balance that can lead to optimal performance. However, if these muscles are not strengthened together, then one significantly increases the risk of injury.

As pitching coach sensation Tom House taught my son Alec during his baseball career, the development of both the acceleration AND deceleration pitching muscles are key to not only becoming a more effective pitcher (better location, more ball movement, more velocity), but also critical in preventing arm, elbow and shoulder problems (see Figure 1).

Figure 1: Alec pitching with the Baltimore Orioles

As I can personally attest from hours and hours of “towel drills” in the rain, one must consciously work on the coordinated development of the complementary muscles necessary to optimize operational performance. And business is no different.

Unfortunately, many business leaders didn’t learn the importance of complementary muscle development while playing sports. And that manifests itself into business executives who seek to optimize the performance of their business unit, sometimes at the expense of the other business units. They achieve stellar performance from optimizing their particular business unit, while the company is being optimized right out of business.

Optimizing the Parts to the Detriment of the Whole

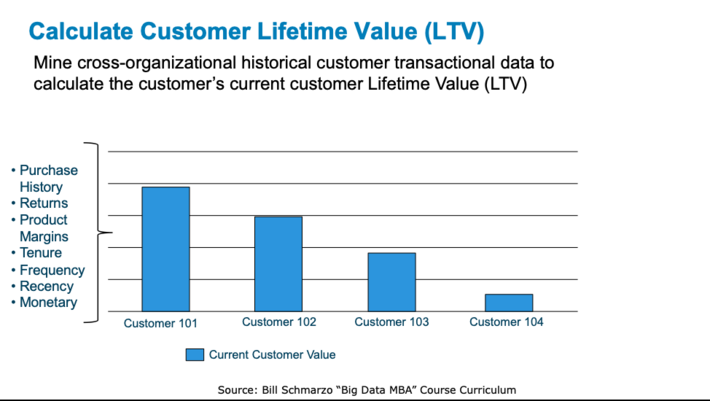

My favorite (and most painful) example was a financial services engagement where we not only calculated current customer lifetime value but tried to predict the potential lifetime value for individual customers. We started by leveraging the historical purchases, returns, market baskets, product margins and sales and support engagement data to create a current Customer Lifetime Value (LTV) score (see Figure 2).

Figure 2: Calculate Customer Lifetime Value (LTV)

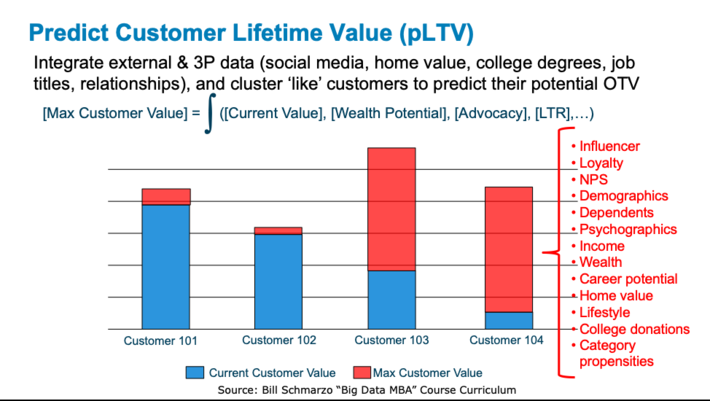

Now imagine the game-changing potential of being able to predict a customer’s potential lifetime value. Use case by use case, you could transition from a customer LTV score that measures how valuable a particular customer “is today”, to creating a Predicted Lifetime Value (pLTV) score that predicts how valuable a customer “might become” and create individualized treatments for making that customer more valuable. This pLTV score would be a more effective tool in helping organizations optimize their sales, marketing, service, support and product development investments with those customers with the most upside (see Figure 3).

Figure 3: Predicting Customer Lifetime Value (pLTV)

To create this Predicted Customer Lifetime Value (pLTV) score, we needed ALL of the customer’s transactions and engagements with the financial services institute – checking, savings, retirement, credit card, home mortgages, car loans, small business loans, and wealth management. The more complete of a view that we had on that customer, the better our ability to predict their lifetime value.

Unfortunately, the small business and wealth management business units would not share their data (they were worried that the information about their most important customers would get “misused”). That meant that our pLTV calculations were not only incomplete, and in some cases, wrong (for example, cutting off a customer’s over-drawn checking and credit card accounts without realizing that they were important small business customers who were using their credit card and personal line of credit to manage fluctuations in payables). Ouch.

See the blog “What Defines Your Most Valuable Customers?” for more details on calculating and leveraging the predicted Lifetime Value score.

The Economic Value of Sharing

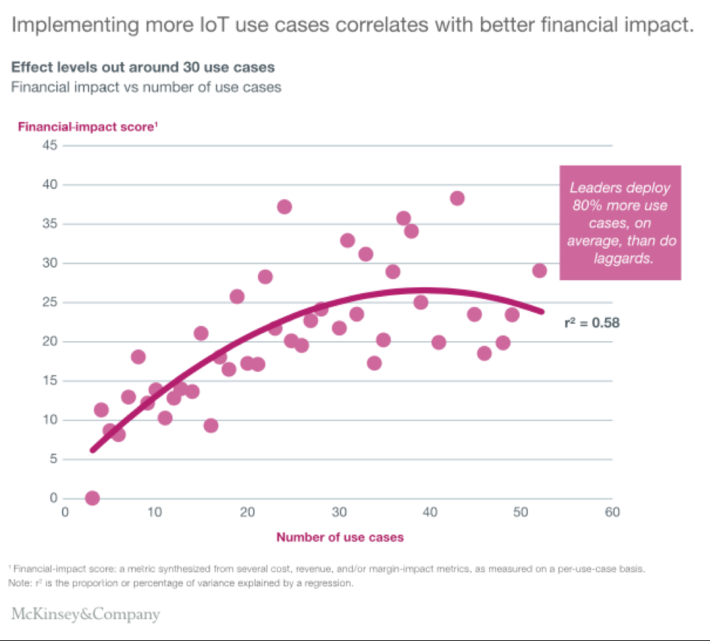

As highlighted by the blog “The #1 IOT Challenge: Use Case Identification, Validation and Prior…”, organizations looking for opportunities to exploit IoT don’t suffer from a lack of use cases; the suffer because they have too many use cases. Organizations need to master the art of collaboration and sharing in order to identify, validate, value and prioritize those use cases.

Organizations need to learn how to build their data and analytics complementary muscles one use case at a time!

The McKinsey report “Ten Trends Shaping the Internet of Things Business Landscape” confirmed that the organization’s greatest financial impact comes from following a learning curve that builds use case by use case, and accumulating and sharing of the customer, product and operational learnings from each of those use cases (see Figure 4).

Figure 4: The Financial Impact of Learning and Sharing

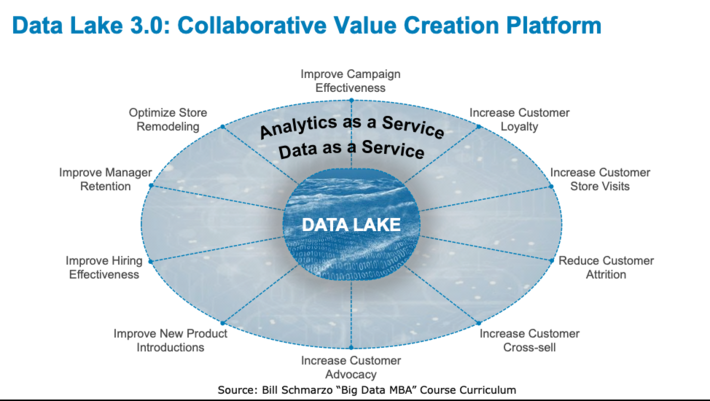

To become more effective at developing the complementary data and analytics muscles to power its business models, organizations must learn how to collaborate across organizational boundaries to capture, and share to reuse the customer, product and operational learnings that are the outputs from these use cases. And more and more, organizations are realizing that the data lake is the “collaborative value creation platform” to facilitate the sharing of the organization’s data assets (see Figure 5).

Figure 5: Data Lake 3.0: Collaborative Value Creation Platform

To pump up the organizational complementary muscles that create this collaborative value creation platform, organizations need to:

- Identify and prioritize the highest potential business use cases using a collaborative envisioning process to facilitate the discussion between different business units in identifying, validating, valuing and prioritizing the right use cases upon which to focus the organization’s analytic resources.

- Identify, prioritize and seek to strengthen (enrich) the data sources loaded into a data lake because not all data is created equal.

- Develop a collaborative data science development processthat integrates with the data lake to support the data science fail fast/learn faster processes of refining the data into actionable analytics to create financial or economic value.

- Build asset models (analytic profiles for humans and digital twins for devices/products) and integrate those asset models with your data to facilitate analytic capture, sharing and re-use across multiple uses cases.

See the blog “Chief Data Officer Toolkit: Leading the Digital Business Transforma…” for more details on the data lake as the Collaborative Value Creation Platform.

Perfecting Your Business Complementary Muscles

Organizations build their complementary organizational muscles when they collaborate to create and share data and analytic assets that support their organization’s key business initiatives. For example, Sales collaborating with Marketing collaborating with Customer Service collaborating with Product Development to address a wide range of use cases including customer acquisition and retention, cross-sell and up-sell effectiveness, advocacy and Likelihood-to-Recommend development, successful new product introductions and marketing campaigns.

But if you are only optimizing your Sales muscles or just your Marketing muscles, then you’ll end up with sub-optimal performance and maybe even the wrong decisions. Professional-caliber athletes understand the importance of developing their complementary muscles in order to achieve optimal performance. Business leaders should take a lesson from these athletes in the critical importance of developing the organizational complementary muscles that derive and drive new sources of customer, product and operational value.

Figure 6: Strong by Science: Optimize professional athlete performance