Senior executives trained in accounting continue to struggle to understand how to determine the value of their data. The article Why Your Company Doesnt Measure The Value Of Its Data Assets written by Doug Laney (by the way, why does the Forbes web site absolutely bury the reader in ads?) contains a telling comment from a senior accounting firm partner:

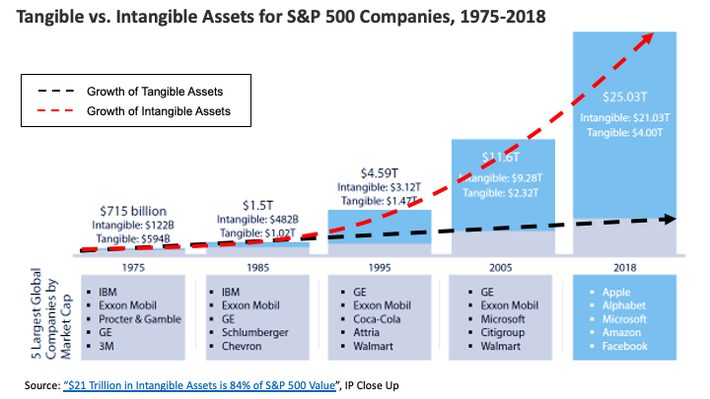

¦ balance sheets and income statements which form the backbone of todays accounting system now fail to capture significant sources of value in our economy. He said that the measurements we use dont reflect all the ways that companies create value in the New Economy, and this lack of transparency results in undue market volatility and mere guesstimates by investors in valuing companies. Even the chairman of the AICPA stated that the accounting model is out of date and based on the assumption of profitability depending upon physical assetsan accounting model for the Industrial Age, not the Information Age.

This paragraph reflects how a traditional accounting mindset, in the age of digital assets, is focused on the wrong valuation method trying to represent value using an artificially-defined balance sheet that doesn’t capture how todays companies are using data to create new sources of customer, product, and operational value.

Nothing says We really dont know how to quantify value in the digital age better than Figure 1 where a significant percentage of the most valuable firms value is credited to nebulous intangible (non-physical) assets. And the discrepancy in the creation of value between traditional physical assets and intangible digital assets is growing exponentially.

Figure 1: Increasing Percentage of Most Valuable Firms defined by Intangible Assets

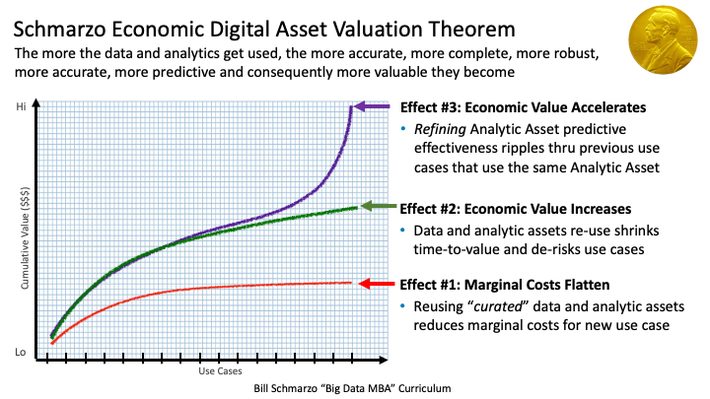

To properly reflect the value of their digital assets, executives must embrace an economics mindset where the value of an assets is determined from the use of that asset. This is critical given the unique economic characteristics of digital assets they never wear out, never deplete, can be used across an unlimited number of use cases at zero marginal cost, and they can appreciate, not depreciate, in value they more that they are used (if properly engineered).

Mastering the Data Monetization Roadmap

I introduced the Data Monetization Roadmap in Introducing the 4 Stages of Data Monetization as a guide to help organizations in their data monetization journey. The roadmap emphasizes that the driver of data monetization is in the use or application of the data to create value. That is, the value of data isnt in possession but in the application of the data to create new sources of customer, product, and operational value.

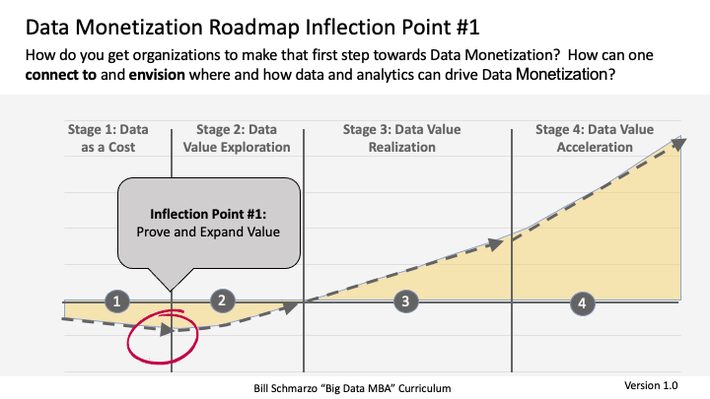

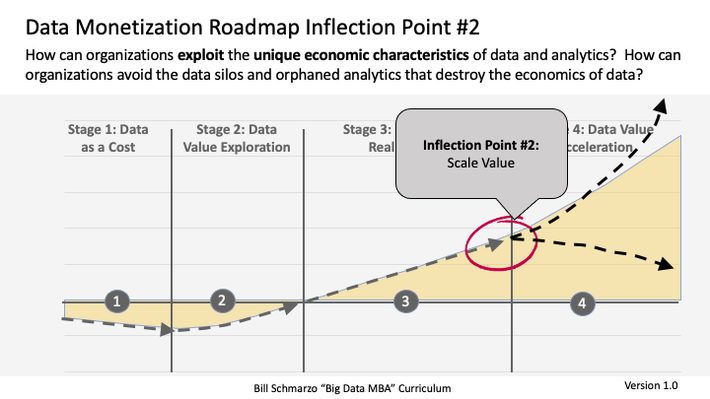

As organizations negotiate the Data Monetization Roadmap, they will encounter two critical inflection points:

- Inflection Point #1 is where organizations transition from data as a cost to be minimized, to data as an economic asset to be monetized. I call this the Prove and Expand Value inflection point.

- Inflection Point #2 is where organizations master the economics of data and analytics by creating composable, reusable, and continuously-learning and adapting digital assets that can scale the organizations data monetization capabilities. I call this the Scale Value inflection point.

Inflection Point #1: Proving and Expanding Value

This pivot point is where the organization makes the transition from just capturing, storing, securing, and governing data to actually monetizing it. How do you get organizations to make that first pivot towards Data Monetization? How can one help the business stakeholders to connect to and envision where and how data and analytics can generate value (see Figure 2)?

Figure 2: Data Monetization Roadmap Inflection Point #1

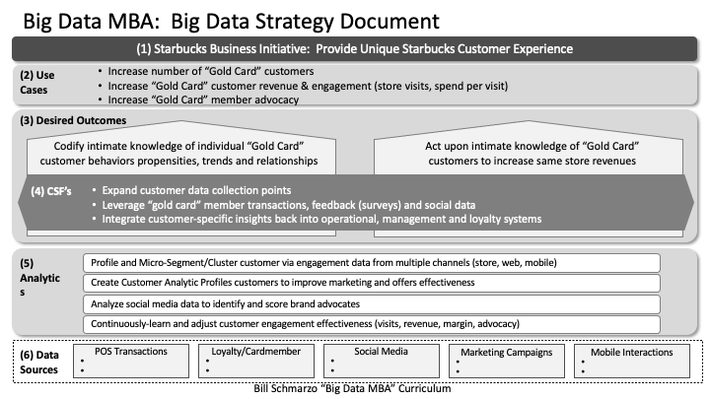

Navigating Inflection Point #1 requires close collaboration with business stakeholders to identify, validate, value, and prioritize the business and operational use cases where data and analytics can create new sources of value. The Big Data Strategy Document in Figure 3 provides a framework for that collaborative engagement process.

Figure 3: Unleashing the Business Value of Technology

The Big Data Strategy Document decomposes an organizations key business initiative into its supporting use cases, desired business outcomes, critical success factors against which progress and success will be measured, and key tasks or actions. The Big Data Strategy Document sets the stage for an envisioning exercise to help the business stakeholders brainstorm the areas of the business where data and analytics can drive meaningful and relevant business value. Yep, there is a lot of work that needs to be done before one ever puts science to the data.

So, now weve given the business stakeholders a taste of success in monetizing their data. Interest is building and others across the organization are asking for help in monetizing their data. Now it gets really fun!

Inflection Point #2: Scaling Data Monetization Potential

The second inflection point occurs just as organizations are scaling their data and analytics success across the organization. More and more business units are coming to the data and analytics team for assistance with their top priority use cases. But remember:

Organizations dont fail due to a lack of use cases; they fail because they have too many.

The volume of use case requests starts to overwhelm the limited data and analytics resources. And when the business units cant get support in a timely enough manner, the business units get frustrated and seek outside solutions. And as these organizations go elsewhere for their data and analytic needs, some fatal developments occur:

- Data Silos. These are data repositories that pop up outside the centralized data lake or data hub. And with the ease of procuring cloud capabilities (got a credit card anyone?), it is easy for impatient business units to set up their own data environments.

- Shadow Data and Analytics Spend. The growing presence of software-as-a-service business solutions make it easy for impatient business units to just buy their solution from someone else. Consequently, money that could be invested to expand the organizations data and analytics capabilities is now being siphoned off by one-off, point solutions that satisfy an immediate business need, but create longer term data and analytics debt.

- Orphaned Analytics. Orphaned Analytics are one-off Machine Learning (ML) models written to address a specific business or operational problem, but never engineered for sharing, re-use, and continuous refinement. The ability to support and enhance these one-off ML models decays quickly as the data scientists who built the models get reassigned to other projects, or just leave the company.

The result: instead of creating data and analytics assets that can be easily shared, reused, and continuously refined, the organization has created data and analytics debt that drives up maintenance and support costs which quickly overwhelms the economic benefits of the data and analytic assets. Welcome to Inflection Point #2 (see Figure 4).

Figure 4: Data Monetization Roadmap Inflection Point #2

What can organizations do to avoid the collapse of the economic value of data and analytics that can occur at inflection point #2?

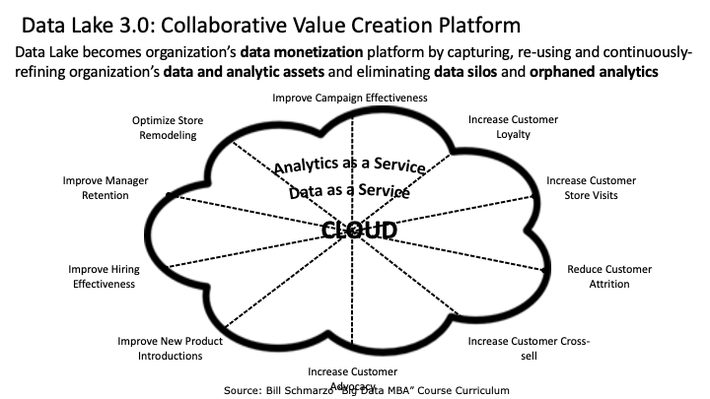

- Data Lake 3.0: Collaborative Value Creation Platform. Leading organizations are transitioning the data lake from a simple, cheaper (using the cloud) data repository to an agile, collaborative, holistic value creation platform that supports the sharing, reusing, and refinement of the organizations valuable data and analytic assets (see Figure 4).

Figure 5: Data Lake 3.0: The Collaborative Value Creation Platform

Data Lake 3.0 employs intelligent catalogs to help the business units find the data they need for their use cases. The data lake also employs intelligent data pipelines to accelerate the ingestion of new data sources, and a multi-tiered data lake environment to support rapid data ingestion, transformation, exploration, development, and production. And eventually, these modern data lakes will transform into contextual knowledge centers that not only help the business units find the data, but also provide recommendations on other data sources (and analytic models) that might be useful for their given use case.

- Data Monetization Governance Council. Another key to navigating Inflection Point #2 is the creation of a data monetization governance council with the teeth to mandate the sharing, reuse, and continuous refinement of the organizations data and analytic assets. If data and analytics are truly economic assets, then the organization needs a governance organization with both stick and carrot authority for encouraging and enforcing the continuous cultivation of these critical 21st century economic assets (see Figure 5).

Figure 6: Data Monetization Governance Council

The key to scaling the organizations data monetization capabilities is to thwart data silos, shadow IT spend, and orphaned analytics that create a drag on the economic value of data and analytics. When the business and operational costs to find, reuse, and refine the data and analytic becomes greater than the cost to build your own from scratch, then thats a failure of the Data Monetization Governance Council.

Mastering the Data Monetization Roadmap Summary

The Data Monetization Roadmap provides both a benchmark and a guide to help organizations with their data monetization journey. To successfully navigate the roadmap, organizations must be prepared to traverse two critical inflection points:

- Inflection Point #1 is where organizations transition from data as a cost to be minimized, to data as an economic asset to be monetized; the Prove and Expand Value inflection point.

- Inflection Point #2 is where organizations master the economics of data and analytics by creating composable, reusable, and continuously refining digital assets that can scale the organizations data monetization capabilities; the Scale Value inflection point.

Carefully navigate these two inflection points enables organizations to fully exploit the game-changing economic characteristics of data and analytics assets assets that never deplete, never wear out, can be used across an unlimited number of use cases at zero marginal cost, and can continuously-learn, adapt, and refine, resulting in assets that actually appreciate in value the more that they are used.

Yes, you could say that the Data Monetization Roadmap is the game plan for fully exploiting the Schmarzo Economic Digital Asset Valuation Theorem. But thats just me and that Nobel Prize in Economics talking¦