As I state in the opening paragraph of my new book “The Economics of Data, Analytics, and Digital Transformation”:

“The COVID-19 pandemic has been exacerbated by incomplete and opaque data supporting suspect analytics, economic turbulence in spite of trillions of dollars spent in overly-generalized financial interventions, and civil unrest from years of ineffective blanket policy decisions. The ability to uncover and leverage the nuances in the data to make more effective and informed policy, operational and economic decisions is more important than ever. However, improving decisions in a world of constant change will only happen if we create a culture of continuous exploring, learning and adapting. Only when the learnings gleaned from the detailed data can be quickly codified, disseminated, and assimilated will we drive more accurate, more relevant policy and operational decisions.”

For companies, governments and social institutions to survive the digitally transforming world, they must change how they frame the wealth and value creation opportunity. Voluminous, granular data at the individual human and device levels – coupled with dramatic advancements in advanced analytics (such as AI, machine learning and deep learning) – has the potential to reinvent the wealth and value creation process via the development and execution of hyper-individualized operational and policy decisions. Gone are the days of overly-generalized operational and policy decisions that focus on delivering “average outcomes.” Welcome to the world of nanoeconomics!

Nanoeconomics was first introduced in 1987 as the economic theory of single transactions[1]. However, given my infatuation with all things related to data, analytics, and economics, I want to update the definition of nanoeconomics:

Nanoeconomics is the economic theory of identifying, codifying and optimizing based upon individual human and device propensities, where propensities are the natural inclinations, tendencies, patterns, trends and relationships for humans or devices to behave or operate in a predictable manner.

Leveraging nanoeconomics, companies, governments and social organizations will be able to create highly-individualized operational and policy decisions that dramatically reduce the execution costs while simultaneously improving effectiveness of these operational and policy decisions. Yes, we will be able to “do more with less” leveraging nanoeconomics.

But first some background on the different branches of economics.

Branches of Economics

Economic theory has traditional been broken into two branches – macroeconomics and microeconomics.

- Macroeconomics is a branch of economics dealing with the performance, structure, behavior, and decision-making of an economy as a whole; the part of economics concerned with large-scale or general economic factors, such as interest rates, taxes, national productivity and government spending to regulate an economy’s growth and stability

- Microeconomics is a branch of economics that studies the behavior of individuals and firms in making decisions regarding the allocation of scarce resources and the interactions among these individuals and firms; the part of economics concerned with single factors and the effects of individual decisions.

As part of an recent conversation that I was having with my friend Gordon MacMaster, VP of Analytics at Reliable Software, he shared with me some research that he had done on a “Socio-economic View of Digital Transformation” (see, there are more latent economist out there than people think). One slide in particular caught my attention was Figure 1.

Figure 1: Power resides in the ownership and control of the “Means of Production”

Karl Marx stated that “Power resides in the ownership and control of the means of production”, where the means of production are physical and non-financial inputs used in the production of goods and services with economic value. And as Gordon pointed out, Karl Marx’s analysis was correct in identifying the means of production as the driver of economic value creation.

However, Marx missed that specialized knowledge is required to operate a “means of production”. And the “means of production” in a digitally-transformed economic model revolves around volumes of granular data, coupled with advanced analytic capabilities to uncover, codify and operationalize insights (propensities, tendencies, inclinations, patterns, trends and relationships) at the level of the individual human or device asset.

Yes, it is that granular insights about customers, products, and operations – their propensities, tendencies, inclinations, patterns, trends and relationships – that is the heart of nanoeconomics.

Let’s drill into the specific aspects of nanoeconomics and how they will drive the means of production in the digitally-transformed economic model. There are two key concepts that organizations need to master in order to exploit nanoeconomics to derive and drive new sources of wealth and value in the age of digital transformation. These two critical concepts are 1) Analytic Profiles and 2) the Economic Value Curve.

1) Operationalizing Analytic Profiles

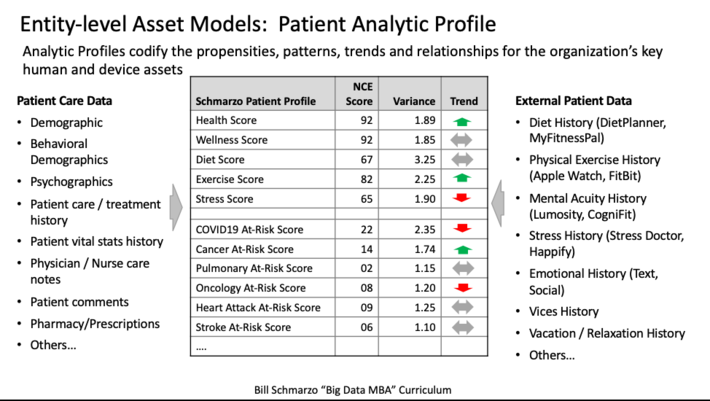

As I discussed in the blog “Analytic Profiles: Key to Data Monetization”, Analytic Profiles codify the propensities, patterns, trends and relationships for the organization’s key human and device assets. Analytic Profiles are really a very straight-forward concept. Instead of storing all the raw data about an organization’s key human (customers, patients, students, technicians, engineers, operators, athletes) and device (compressors, clutches, jet engines, cars, locomotives, CAT scanners, wind turbines) entities, an Analytic Profile stores the metrics, predictive indicators, segments, scores, and business rules that codify the behaviors, preferences, propensities, inclinations, tendencies, interests, associations and affiliations for the organization’s key business entities (see Figure 2).

Figure 2: Analytic Profiles (Asset Models)

Analytic Profiles provide a model for capturing and codifying insights about the organization’s key business entities in a way that facilities the refinement and sharing of the analytic insights about those assets across multiple business use cases. It is around these Analytic Profiles that organizations will build a significant percentage of their analytics (e.g., detect anomalies, predict next best action, optimize utilization, load balancing, minimize inventory, rationalize products, predict maintenance needs. flag questionable activities).

2) Economic Value Curve

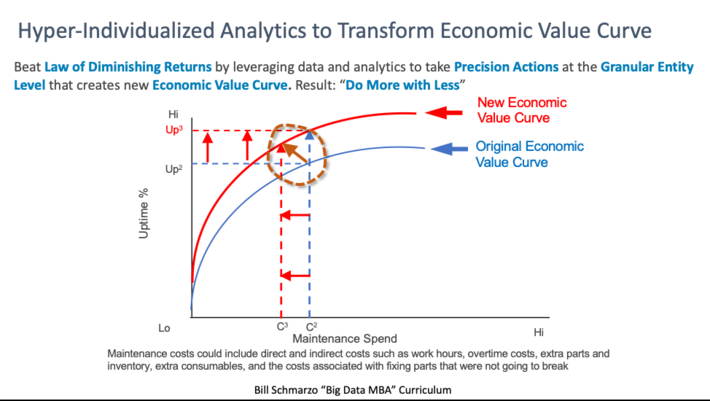

In the blog “Using the Economics Value Curve to Drive Digital Transformation”, I explain how trying to optimize across a diverse, sometimes conflicting, set of metrics can help organization’s transform their economic value curve. The Economic Value Curve is a measure of the relationship between a dependent variable and independent variables to achieve a particular outcome such as retain customers, increase operational uptime, or optimize inventory.

The challenge with the economic value curve is the “Law of Diminishing Returns.” The Law of Diminishing Returns states that a decrease in the marginal (incremental) output of a production process as the amount of a single factor of production is incrementally increased, while the amounts of all other factors of production stay constant.

Organizations can overcome the “Law of Diminishing Returns” by optimizing across a diverse, sometimes conflicting, set of metrics to prescribe highly-individualized precision actions at the individual human or device level (think Analytic Profile). For example, leveraging granular insights of your technicians, products, inventory, and customers to prescribe individualized human and device actions that can increase operational uptime while reducing maintenance costs while improving customer satisfaction while reducing carbon footprint while increasing employee job satisfaction (see Figure 3).

Figure 3: Hyper-individualized Analytics to Transform One’s Economic Value Curve

This is where the power of nanoeconomics – the economic power to identify, codify, and optimize based upon individualized human and device propensities – drive economic value or wealth creation. Nanoeconomics enables organizations to transition from overly-generalized operational policies (that are designed to deliver “on average” outcomes) to more effective operational and economic decisions powered by individualized customer, product, and operational propensities.

Nanoeconomics Summary

Nanoeconomics – a new branch in the discipline of economics that complements macroeconomics and microeconomics – is the key to leveraging Analytics Profiles to transform one’s economic value curve by driving precision corporate, institutional, and society policy and operational decisions. Nanoeconomics – the economic theory of individual human and device propensities (think Analytic Profiles) – is the key to transforming an organization’s economic value curve and unleashing the ability to doing more with less!

Yep, “do more with less”… the Post-COVID new normal. Dang, I love economics!

[1] Nanoeconomics, Wikipedia https://en.wikipedia.org/wiki/Nanoeconomics