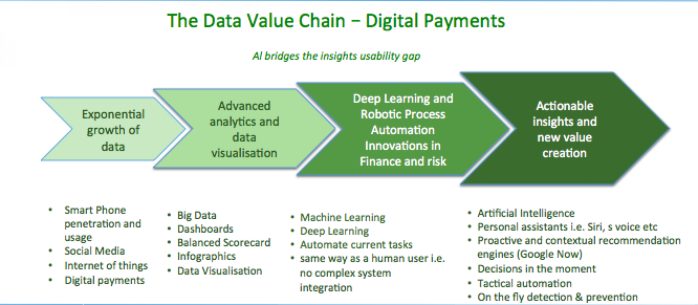

Abstract – Big data helps to make strategy for future and understand user behaviors. In 1959, Arther Samuel gave very simple definition of Machine Learning as “a Field of study that gives computer the ability to learn without being explicitly programmed”. Now almost after 58 years from then we still have not progressed much beyond this definition if we compare the progress we made in other areas from same time. The idea of FinTech adopting some best practices from the Big Data and AI (Artificial Intelligence , Machine Learning and Deep Learning) is not so new, have you heard of accepting selfie as authentication for your shopping bill payment, Siri on your iPhone etc. A Decentralized Autonomous Organization (DAO) is a process that manifests these characteristics. It’s code that can own stuff. Self-driving car is an excellent example for this. What if you use blockchain to store the state of machine. The key move for blockchain-enabled thinking is that instead of having just one instance of a memory, there could be arbitrarily many copies of a memory, just as there can be many copies of any digital file.

Though this sounds very interesting and exciting but before we start dreaming any thing beyond its very important and critical to deliberate in details about pros and cons it brings. World wide development in Financial Technology sector is happening almost every day and “Change” is the only constant factor or critical stake holder of this industry. Can we dream of guarding an innovation department or powerhouse lab is a smart setup without inbuilt component of artificial intelligence is like an effort of joining blocks without reference of previous block

My understanding out of ‘everything going on around the world’ on mobile payments front I must say we ‘should avoid creating creative mess’, stop innovating for some time and start improving. For test purpose, lets measure success and repeat what works for me very well (Off course process of innovation does not stop completely). Developing something new on top of other “things” is not always the answer. Sometimes its ok and good for everyone to un-develop something existing to uncover the hidden gems which are already there and are useful. May be its like Un-Develop to Innovate? Alan Turing published “Turing Test” that speculates the possibility of creating machines that think. In order to pass the test, a computer must be able to carry on a conversation that was indistinctive from a conversation with a human being.

My understanding out of ‘everything going on around the world’ on mobile payments front I must say we ‘should avoid creating creative mess’, stop innovating for some time and start improving. For test purpose, lets measure success and repeat what works for me very well (Off course process of innovation does not stop completely). Developing something new on top of other “things” is not always the answer. Sometimes its ok and good for everyone to un-develop something existing to uncover the hidden gems which are already there and are useful. May be its like Un-Develop to Innovate? Alan Turing published “Turing Test” that speculates the possibility of creating machines that think. In order to pass the test, a computer must be able to carry on a conversation that was indistinctive from a conversation with a human being.

This was the first serious proposal in the philosophy of artificial intelligence, which can be explained as: a science developing technology to mimic humans to respond in a circumstance. In simple words AI involves machines that behave and think like humans i.e Algorithmic Thinking in general. Computers start simulating the brain’s sensation, action, interaction, perception and cognition abilities.

Main Story – We have excellent young professionals working in today’s time with dream of changing the world by brining the values to society, business and people. During my time (around 19 years back) we had no such option to learn or to choose popular professions. It was mainly R&D for anything unusual and use regression techniques if you want to be data scientist or simply an engineer in computer software or hardwares. Blockchain is a new approach to manage/monitor financial and other transactions,. To draw a rough sketch of exaggerated scenario of how these two technologies (AI & FinTech) may interact with us in the future and what warrants the, perhaps perplexing, 2 super powers. AI’s Control systems are widely used. They govern how a simple thermostat adapts to a target temperature.

Views here are from many of my friends, colleagues and reading through web. All credits if remains with the original contributor only. Sir Andrew Ng tells MIT that even though large tech companies have already implemented AI to improve search engines, payment systems, online maps and advertising, there is still a lot of work to be done to advance AI. This is work that Ng says can’t be done just by one company or a few companies. Everyone and everyone’s talents can be bolstered by AI to help fill in the gaps, echoing the fact that collaboration helps refine and expedite the development of valuable technologies.

The biometric authentication feature associated with mobile wallets is a great example with promising feature but still very far from reality to a common man i.e. basic security that can catch the fraudster with behavior biometrics though. With AI power to enable security features of mobile payments mean the technology could gain traction in other areas of B2B payments and escalate blockchain to generalize, any previous application of AI, but now the AI “owns itself”. We might have a future where humans own nothing, we’re just renting services from AI DAOs. Chatbots harness software that uses artificial intelligence (AI) to process language from interaction with humans in chat programs and virtual assistants. For humans habits and behaviors are very difficult to change and if we can identify legitimate users by their typical behavior patterns – we can detect anomalies on a totally new level. Same goes with fraudsters – ability to identify and quantify behavior patterns of cyber criminal will allow us to uncover and neutralize threats that may be undetectable by other means. The concept of chat bots are coming up very fast but its limited to too many issues.

The biometric authentication feature associated with mobile wallets is a great example with promising feature but still very far from reality to a common man i.e. basic security that can catch the fraudster with behavior biometrics though. With AI power to enable security features of mobile payments mean the technology could gain traction in other areas of B2B payments and escalate blockchain to generalize, any previous application of AI, but now the AI “owns itself”. We might have a future where humans own nothing, we’re just renting services from AI DAOs. Chatbots harness software that uses artificial intelligence (AI) to process language from interaction with humans in chat programs and virtual assistants. For humans habits and behaviors are very difficult to change and if we can identify legitimate users by their typical behavior patterns – we can detect anomalies on a totally new level. Same goes with fraudsters – ability to identify and quantify behavior patterns of cyber criminal will allow us to uncover and neutralize threats that may be undetectable by other means. The concept of chat bots are coming up very fast but its limited to too many issues.

Can we really develop and enter into behavioral biometrics to level requires. The field of study related to measure of uniquely identifying and measurable patterns in human activities is still far from such developments and lot needs to be done. In 2017, why we dont have some very basic measure in place for every payment system for example when someone type his/her own password or PIN. We humans are same and lazy enough and love not the accept or like changes but wants to shout slogans “change is the only constant thing”. Our habits of about using computers, mobile devices or almost everything in a ways that are unique and consistent with our own biology and physiology. System should be able to learn the behaviour and style and when the same person types 3rd person password or PIN system should be able to detect and raise alarm. The way some one click and type, the way any one use mouse and other input devices are pretty consistent with that person’s own behavior, habits, education level, and familiarity with a service or system. Basic security of typing wrong password is no longer good or doing anything good.

Architecture of Convolutional Neural Networks (CNNs) needs to be demystified for Fintech world to make full use of it. Volume, velocity and variety are main characteristics of big data. How these can be used as part of any Fintech software where volume or amount of data with high velocity to help in data processing on variety of Information or data.

As the demand for data science expertise grows, so does the need for tools that deliver flexibility, speed, and ease of use. Organizations need solutions that can access several data types such as Big Data; offer a vast library of algorithms, including the most popular open source methods; and are accessible to expert coders and non-coders alike. Python algorithms for non-coders to provide greater analytical power and flexibility. Secure Electronic Transaction enables interoperability between applications across diverse platforms and operating systems this is how various free open source modeler can help data scientists and analysts to extract important insights from data in a powerful, flexible and easy way. Authenticating cardholders and merchants, ensuring confidentiality of information and payment data, define protocols and electronic security service providers, Digital Wallet Software − Secures cardholder’s online purchases via point and click interface. With the public key that is used to sign communication with that entity in a cryptographic system. Seamless integration with Decision Optimization to help you determine the best scenarios for your business and budget.

As the demand for data science expertise grows, so does the need for tools that deliver flexibility, speed, and ease of use. Organizations need solutions that can access several data types such as Big Data; offer a vast library of algorithms, including the most popular open source methods; and are accessible to expert coders and non-coders alike. Python algorithms for non-coders to provide greater analytical power and flexibility. Secure Electronic Transaction enables interoperability between applications across diverse platforms and operating systems this is how various free open source modeler can help data scientists and analysts to extract important insights from data in a powerful, flexible and easy way. Authenticating cardholders and merchants, ensuring confidentiality of information and payment data, define protocols and electronic security service providers, Digital Wallet Software − Secures cardholder’s online purchases via point and click interface. With the public key that is used to sign communication with that entity in a cryptographic system. Seamless integration with Decision Optimization to help you determine the best scenarios for your business and budget.

If you remember the concept universal golden ratio where Its a special number found by dividing a line into two parts so that the longer part divided by the smaller part is also equal to the whole length divided by the longer part. Applying this phenomena on fintech data to achieve best possible output i.e number of transactions from each user with highest activity ratio will make it wow.

Cybercrime is estimated to cost the global economy 400 billion dollars (source McAfee). Credit card fraud accounts for a large proportion of this cost. While fraud detection techniques have been used for decades, the industry now faces new challenges. Artificial Intelligence (AI) techniques are proposed to overcome the increasing challenges of online fraud. AI techniques are gaining popularity due to the power of Deep Learning Algorithms. You definitely listed some valid challenges banks will face when implementing AI into their processes. One thing that I think you could’ve talked a bit is the role of regulation; just like healthcare, I believe finance has been slow to reinvent itself due to the slow-moving legislative frameworks. Of course machine learning is used in many other areas and for more complicated solutions such as fraud prevention, risk analysis, gaining batter customer insight and improving medical science among other uses. As a field with broad scope, the problem of creating intelligence has been broken down into a number of sub-problems which later, each subset became a separate field of study to solve its problem.

CCC (Computing Community Consortium) is telling lot os initiatives to understand and com up with answer for questions like ‘Where is the computing field going over the next 10-15 years?’, ‘What are potential opportunities, disruptive trends, and blind spots?’ and ‘Are there new questions and directions that deserve greater attention by the research community and new investments in computing research?’. But I want to relate them to my questions and suggestions to stop for some time and look around what we already have. Many websites now offer customers the opportunity to chat with a customer support representative while they’re browsing—but not every site actually has a live person on the other end of the line. In many cases, you’re talking to a rudimentary AI. Many of these chat support bots amount to little more than automated responders, but some of them are actually able to extract knowledge from the website and present it to customers when they ask for it.

If you apply my same question here i.e we have this and now do we need any other solution or should we stop and refine it and make it more intelligent, accurate and smart to wow customer support. Perhaps most interestingly, these chat bots need to be adept at understanding natural language, which is a rather difficult proposition; the way in which customers talk and the way in which computers talk is very different, and teaching a machine to translate between the two isn’t easy. But with rapid advances in natural language processing (NLP), these bots can get better every day with right amount of focus and time.

If you apply my same question here i.e we have this and now do we need any other solution or should we stop and refine it and make it more intelligent, accurate and smart to wow customer support. Perhaps most interestingly, these chat bots need to be adept at understanding natural language, which is a rather difficult proposition; the way in which customers talk and the way in which computers talk is very different, and teaching a machine to translate between the two isn’t easy. But with rapid advances in natural language processing (NLP), these bots can get better every day with right amount of focus and time.

AI has taken some steps into banking, but it also is poised to revolutionize how banks learn from and interact with customers. As development trend for the operation support system, convergent billing, money storage as digital numbers i.e bits and bytes has broad scope that is not limited by a single standard. Artificial Intelligence (Cognitive Computing) will play a bigger role. Its development may follow different directions. Through different security threats. However, which is the best direction? The answer lies in the analysis of future technologies development within the 3GPP framework (For Telecom), FinTech, AI and AGI, Machine learning & Deep Learning, Threat Intelligence will play a bigger role coupled with an evaluation of the driving factors and key capabilities required by convergent systems and requirements. There’s no single answer to this without end-to-end architectural analysis. AI and blockchain combination is explosive! Blockchain technologies . It can help realize some long-standing dreams of AI and data analysis work, and open up several opportunities.

Conclusion – What fascinated me most the explanation of such complex subject regression it was described as ‘ a tutor teaching students in an institute – if outcome is continuous use linear and if it is binary, use logistics’. That’s simplistic for a reader to appreciate the importance of Regression. Historical notes on KDD (Knowledge discovery and data), CRISP-DM, BIG DATA, and Data science and their relationship to data mining and Machine Learning are available all over internet for free but how to put them in real business and discover the hidden potential of such powerful tools to bring values are still not much talked or explored. Nothing is new or innovative here its just the discovery needs to happen of these excellent innovative and used tools. Please don’t read my lines as if I am saying Isaac newton discovered gravity in 1400, that mean people were flying before that. No not at all; all I am saying how can we stop new innovations and look around to see what can be reuse and stop creating creative mess for some time. Discovery and invention needs to understood well. Just collecting evidence does not defined as discovery like collecting data from any or many source is Big Data but its not equivalent to data science. Data science is a technique to predict trends, future etc. Please note: I am saying in clear words that Data Science (DS) and Big Data(BD) are two very different animals.

========================== About the Author ===============================

Read about Author at : About Me

Thank you all, for spending your time reading this post. Please share your feedback / comments / critics / agreements or disagreement. Remark for more details about posts, subjects and relevance please read the disclaimer.

FacebookPage Twitter ContactMe LinkedinPage ========================================================================