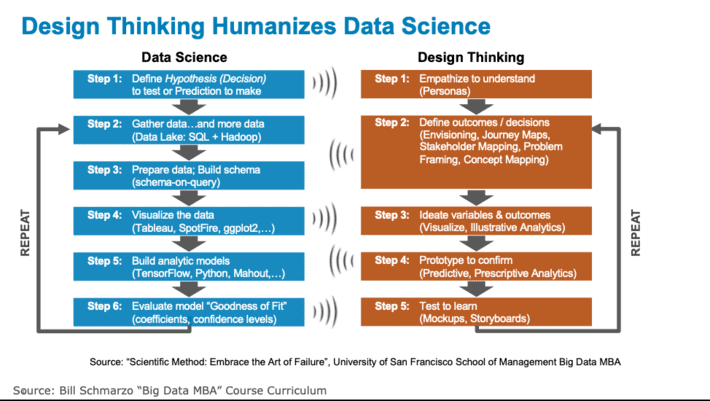

In my most recent blog “Design Thinking Humanizes Data Science”, I discussed how Design Thinking and Data Science complement each other. They are not just two sides of the same coin, but the same side of the same coin in their objectives to “diverge before converging” in driving business stakeholder collaboration with respect to identifying, brainstorming and envisioning the variables and metrics that might be better predictors of performance (see Figure 1).

Figure 1: Design Thinking Humanizes Data Science

The complementary natures of Data Science and Design Thinking are bonded by several common characteristics including:

- Open culture for sharing and ultimately standing on the shoulders of others

- Inclusive culture where “All ideas are worthy of consideration”

- Learning culture that gets smarter through experimentation (and failure)

- Willingness culture to unlearn old methods and perspectives in order to embrace new ones

Maybe the most important cultural similarity between Data Science and Design Thinking is the mentality that if you don’t have enough “might” ideas, you’ll never have any “breakthrough” ideas.

In this blog, I want to combine the value creation focus of Economics with Data Science and Design Thinking. I want to use Economics as the Digital Business Model Transformation guide in leveraging Data Science and Design Thinking to drive cultural change and business model disruption.

Economics, Say Hello to Design Thinking and Data Science

A recent article from the University of Chicago Booth School of Business titled “Why Artificial Intelligence Isn’t Boosting the Economy—Yet” highlights a common problem with new disruptive technologies – there are substantial upfront investments in these disruptive technologies, resulting in a negative short-term Return on Investment (ROI). To quote the article:

“The economy is early in the AI adoption wave, with start-up funding for AI having increased from $500 million in 2010 to $4 billion in 2016. According to the researchers, this implies intangible investments in AI may have accounted for 0.55 percent of “lost” output—or output that national productivity statistics didn’t measure—in 2017.”

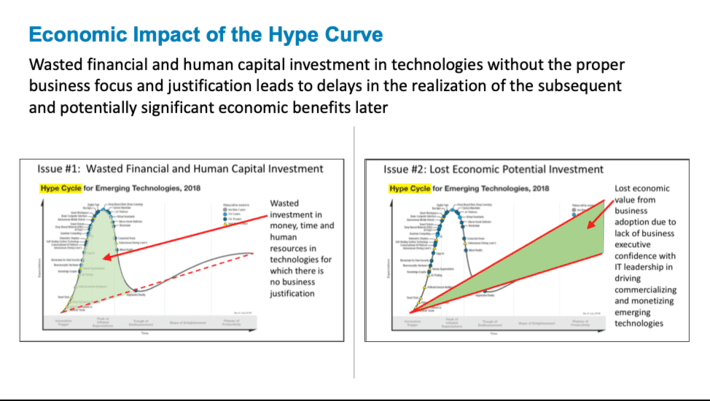

In my blog “Why Accept the Hype? Time to Transform How We Approach Emerging Tec…”, I highlight that the biggest cost for emerging technologies is the lost economic potential caused by early mis-positioning. The emerging technologies never gain the level of organizational adoption necessary to drive material economic impact (see Figure 2).

Figure 2: Lost Economic Value Due to Over-hyped and Mis-positioned Technologies

In further exploration of the dangers of the Hype Curve, I realized that I had the right idea but the wrong perspective. It’s not a “technology hype” issue, it’s an “economics productivity” issue! The real issue is the economic “Productivity J-Curve”, which is the time period in emerging technology investments where productivity growth is underestimated, followed by a period where its productivity growth is overestimated.

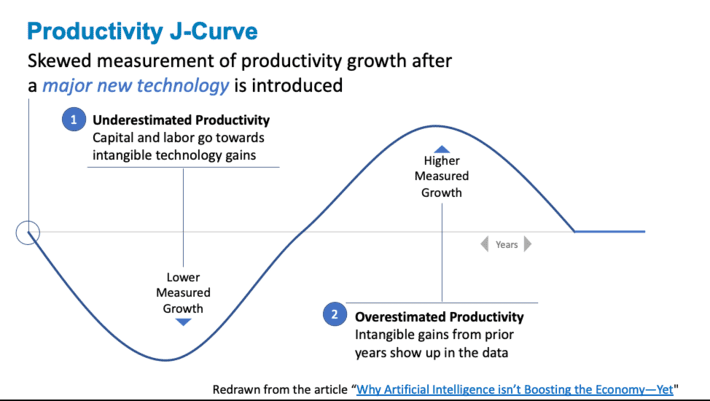

The research paper “The Productivity J-Curve: How Intangibles Complement General Purpos…” written by Erik Brynjolfsson, Daniel Rock, and Chad Syverson introduced the Productivity J-Curve (see Figure 3).

Figure 3: From the article “Why Artificial Intelligence isn’t Boosting the Economy—Yet

The Productivity J-Curve postulates that companies must make significant upfront investments in order to exploit the economic potential of new, disruptive technologies. For example, organizations looking to exploit the economic potential of artificial intelligence would need to make upfront investments such as new hardware, new software, updated information technology architecture, establishment or expansion of a data lake, employee training, new hires with new technology skills, and management education. And, of course, the biggest investment will be in gathering, integrating, validating, cleaning, correcting, normalizing, engineering, transforming and enriching the data.

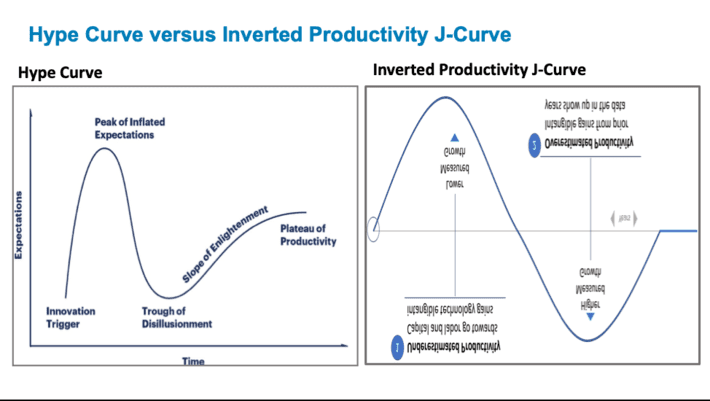

Note: it is interesting to see that the economic Productivity J-Curve is nearly the inverse of the Hype Curve, for whatever that’s worth (see Figure 4).

Figure 4: Hype Curve versus Inverted Productivity J-Curve

So how do we minimize the Productivity J-Curve “Underestimated Productivity” ramifications? How do we get to a faster return on investment on these emerging technologies? Enter the economic Learning Curve.

Understanding the Economic Learning Curve

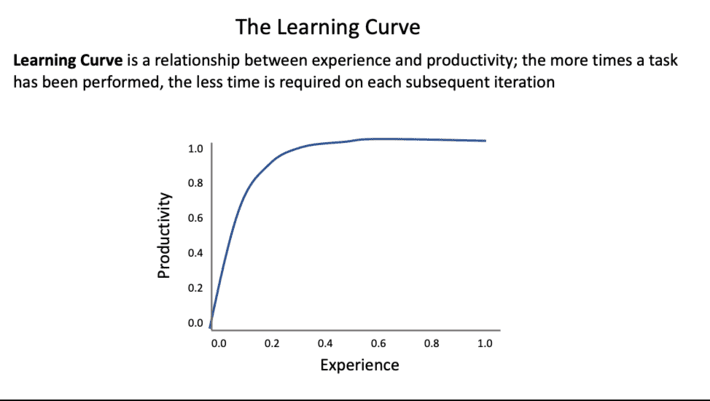

The economic Learning Curvedescribes the relationship between experience and productivity; how experience accumulated around a specific task drives down the cost of the execution or performance of that task (see Figure 5).

Figure 5: The Learning Curve

The Learning Curve concept was the subject of Malcolm Gladwell’s book “Outliers, The Story of Success” that postulated that practicing a specific task for 10,000 hours (20 hours a week for 10 years) is required to achieve world class performance (a rule that has been challenged, but that’s not the focus of this blog).

So how do we accelerate the learning curve in order to get the area of higher productivity when we don’t have 10,000 free hours to invest? Meet the world of economics.

Call to Action: Data Science meets Design Thinking, Ruled by Economics

The key to accelerating the economic learning curve isn’t just accumulating experience, but also requires a few other items to successfully accelerate the learning curve. Going back to the “Why Accept the Hype? Time to Transform How We Approach Emerging Tec…” blog again, we get the following recommendations:

1) Begin with an End in Mind. Understand your organization’s key Business Initiatives. Understand what’s important to the organization from a business, financial and/or customer perspective, and use that to frame and accelerate the monetization of your artificial intelligence efforts. While we may not understand the technology journey that we’ll experience trying to reach that end, the end point should not be a mystery.

2) Understand the Technology Capabilities…But Within a Business Frame. It’s important for IT to gain familiarization with how the artificial intelligence technologies work, what’s required to support the AI technologies, and what sorts of business and/or operational opportunities can potentially be addressed with artificial intelligence technologies.

3) Build out the Solution Architecture. Organizations should embrace a holistic architecture that supports big data, IoT, and agile application development in order to leverage artificial intelligence technologies to deliver “intelligent” applications (applications that get smarter with every customer interaction) and “smart” entities (that leverage edge-to-core IOT analytics to create “continuously learning” entities).

4) Use Design Thinking to Drive AI Organizational Alignment and Adoption. Embrace Design Thinking as a way to drive organizational alignment and adoption with respect to where and how artificial intelligence technologies can be best deployed to drive meaningful business and operational value.

These four items provide the recipe for prioritizing financial and human investments in those tasks designed to accelerate an organization’s Artificial Intelligence learning curve. Ultimately, we can blend the value creation focus of Economics – with the customer, product and operational analytics insights discovery of Data Science and the ideation, alignment and adoption capabilities of Design Thinking – to help organizations of all sizes to exploit the economic value of Artificial Intelligence.