Source: SutiSoft

For the most part, it was straightforward to manage expenses two decades ago. Management knew where all of their money was going and could monitor with a high level of satisfaction. The number of expense categories has increased considerably since then.

Then there was globalization. Companies began expanding, people started traveling worldwide, and businesses began offering need-based software on a subscription basis. To put it another way, costs increased, and the intricacy of the categories also rose.

As it always is with humanity, many people were (are) not happy about the change, and its expense management grew difficult.

Manually documenting expenses and data and manually entering it into a spreadsheet can lead to missing important information in today’s world of business transactions. For them, mistakes are a common occurrence, and managing expenditures is a chore. Human assistance is necessary at every stage, making the process useless.

In addition, there are additional costs associated with paperwork in the expense management process.

To summarize, firms that resist automation of cost management have a higher occurrence of mistakes, redundant procedures, and overall lower morale among employees.

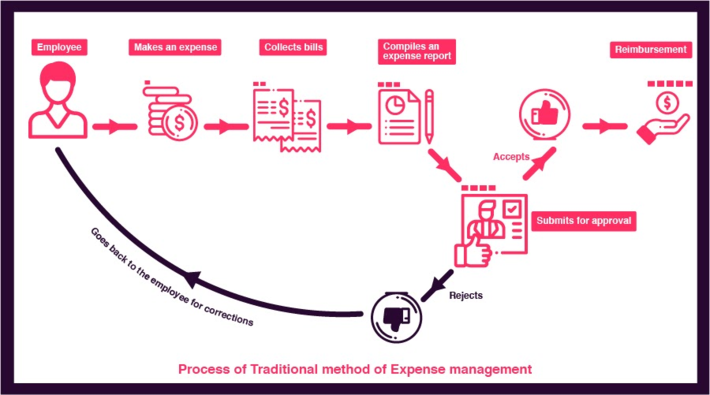

Traditional expense management

Source: Fyle

There is a common saying that old is gold, yet this may not always be true.

In traditional expense management, the corporate employees need to submit the receipts of their office expenses. They will then spend time verifying and processing them with an employee or contractor responsible for managing the expenses.

This method works well when only one person is doing all the work; however, if it has multiple people involved in this process, they typically end up spending about 20 hours a month on processing expenses.

Thus, you can see that expense management in companies still means cluttered paper receipts, disorganized excel spreadsheets, time-consuming and tedious validation processes. It is an old-fashioned approach to handle expenditures and expenses.

Let us understand the general issues with a traditional way of expense management-

Issues with the traditional way of expense management

- Wastage of time and Efficiency

The time and efficiency losses incurred through long hours spent on detailed and monotonous expense reports could have been utilized to accomplish other critical work.

- Information about spending trends

Because no data is aggregated at any level, it’s challenging to get spending patterns, which means minimal or no savings.

- Increased risk of fraudulent claims

This can be achieved by providing fraudulent bills, exaggerated claims, and false receipts.

Automated expense management

Source: The Business Journals

Most business owners know that their companies spend an average of 6% of their revenue on expenses. The more income you can generate, the less your expenses will weigh down your bottom line. With automated expense management software in place, business owners can create a virtual handle on the discretionary spending in their company, which they can tighten and loosen as need be.

The technology works by instantly monitoring each purchase made with a company credit card, deducting it from the virtual account held in its system. When you’re ready to review an expense report for that accounting period, automated expense management software makes this as easy as a few mouse clicks. The software automatically categorizes expenses and compiles an expense report, which you can then use to identify any trends in spending.

What changes can automated expense management bring to your business?

Automated expense management will automate the following critical areas of your business-

- AR & AP Management

Source: Tally Solutions

Automated AR and AP Monitoring – One of the most significant developments in accounting automation is the development of Automated Accounts Receivable (A/R) and Automated Accounts Payable (A/P).

These automated systems can handle all aspects of payroll and human error, freeing up accounts receivable personnel to focus on more complex tasks. This system allows for 100% accuracy in paydays, payroll processing, and remittance.

An automated account management system has many benefits, such as increased efficiency, continual monitoring with real-time updates as necessary or requested by clients, lower operating costs with fewer staff requirements, and industry-leading transaction rates, which save money. This is an excellent way to manage expenses in the quickest manner possible.

- Multiple Payment Gateways

Source: FinSMEs

Multiple payment gateways offer several advantages. Service providers can remain in compliance with the law, meet customer needs and expectations with a variety of payment options, including credit card use – which is hard to do if you have only one gateway.

Multiple payment gateways are more secure than having just one form of transaction available on your website. It means more people are likely to buy from sites with multiple options because they know there is at least one way to pay without encountering an issue with their bank or credit card provider denying the transaction at checkout time.

Request a free demo of Invoice software that offers 10+ payment gateways-

- Estimate Management

Source: Pro Remodeler

An estimate is a set of cost predictions for the work that will take place over a certain period of time. This can be time and materials needed, labor hours required, total direct costs estimated, and many other factors.

One significant advantage of this management strategy is that it ensures fidelity to the budget by monitoring each project consistently, so companies avoid costly variance problems in their execution.

Automated estimate management helps establish an accurate budget or projects much more quickly than traditional spreadsheet-based approaches such as economies-of-scale calculations, which often cannot provide timely information about pricing dynamics at specific levels in the value chain across various markets and sources of supply.

You will also get better visibility into indirect costs hidden in manual estimates or challenging to track when using spreadsheets.

- Financial Forecasting

Source: Toolshero

Financial Forecasting is the projection of financial transactions in the future.

Forecasting budgets for an organization can help you plan long-term expenditures, identify your company’s economic climate and incentives, and allow you to adjust projected revenues based on trends in various markets that may exist.

Forecasting allows companies to be proactive in identifying issues before they become significant problems. It is valuable when it comes to budgeting because it provides crucial data about what needs to happen, whether finding more revenue or spending less money. It also alerts companies when their sales are trending downward to alter or expand their business strategy accordingly.

Finally, forecasts can create awareness of hazardous financial situations which might arise if budgets aren’t reworked; this way, financial problems can be avoided.

Factors to consider before going for automation

- Flexibility:

You must select the tool that offers flexibility. It means adapting spending to the demands of an employee. Some applications, for example, allow you to design your own cards and set monthly boundaries for particular spend categories.

- Security

Security is another essential factor to be considered before investing in any expense management tool. Spending is happening on so many levels that the security of company money becomes critical.

An expense management tool with real-time spend verification or one-time-use virtual credit cards helps the administration to relax.

- Easy Integration

The expense management software should integrate with existing ERP and CRM to aid in the smooth transition. It contributes to optimum utilization of resources and minimizes invoice discrepancies.

The invoice software tracks all the expenses and keeps a record of payment done to respective vendors, ensuring proper invoice billing and invoice alerts.

- Real-time checks

Real-time checks are important to ensure that spending is within limits and no fraudulent activities are being conducted. You can do this with invoice software.

The invoice software tracks all the financial activities of a person and gives instant reports. These reports are helpful for those who have to file taxes and those who need to track their expenditures over a period of time.

What is the best task managing software to fulfill all of those criteria? Let’s explore further to know the answer.

Ideal expense management tool for your business

Invoicera is a cloud-based accounting tool for businesses. It is designed to help you manage your business finances, save time and do more with less.

Invoicera automates workflows needed to process invoices and get data into your company systems. You can create templates for recurring revenue streams or daily tasks that need attention, then copy the templates as required to ensure consistency across team members and departments.

Moreover, it comes with essential reporting features that help you understand how well your business is performing to make better decisions faster about where to put resources or what changes are needed to grow your business faster.

Invoicera is successfully delivering outstanding results for more than 17 years to the following industries-

- Utility

- Telecommunications

- Transportation & Logistics

- Real Estate

- Legal Firms

- Tours & Travels

- Restaurant and Hotel

- Traders

- Photographers

- Consultants & IT firms

- Contractors

- Insurance & Banking

- Manufactures

- Digital Agencies

Try the expense tracker app for yourself, sign up for a free trial here-

Before we say goodbye!

No matter how big the business is, it’s critical to stay on top of company spending to reduce costs and develop the budgeting structure. There are no better methods to accomplish this than through automation.

Unfortunately, many firms miss out on time and productivity due to a lack of foresight in this direction.

The ideal option is to use an all-in-one platform like to house your transactions centrally, giving any level of management real-time insight into spending patterns and trends. This, of course, results in greater budget use and increased employee morale by allowing employees to do what they were hired for.

Well!! That’s it for today! If we forgot to mention any important aspect, please tell us in the comment section.

Thanks for reading!