Summary: McKinsey says platform companies will represent 30% of global business revenue by next year (2020). In Part 1 of this article we started to lay out some important lessons learned and examples for you to follow. Here are the rest.

McKinsey says platform companies will represent 30% of global business revenue by next year (2020). In Part 1 of this article we started to lay out some important lessons learned and examples for you to follow. Here are the rest.

The goal here is to describe how mature companies can benefit from platform strategy either by building a parallel platform offering or by executing a complete pivot to this new approach. If you’ve pretty much exhausted the standard strategies of line and channel extension, and verticalizing your supply chain, these lessons are for you.

In Part 1 we described these lessons:

- Information centric businesses are obvious targets. (E.g. insurance, mortgage lending, media, telecom, real estate brokerage).

- Since network size is the measure of success, it is more likely these will be B2C.

- Fragmented industries are good targets.

- Best of all find fragmented markets that are under served.

- Yes there is competition among emerging platforms so first movers who execute well are favored.

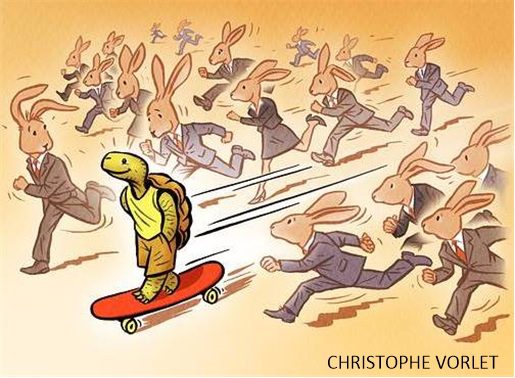

- Don’t wait to get started or you could end a commodity in someone else’s network platform.

Now let’s continue:

- In addition to fragmented markets, look for markets with a large imbalance of knowledge between buyer and seller.

New and Used Cars

The travel insurance example above illustrates information asymmetry, but for an even simpler example look no further than new and used car sales.

In new car sales such a large percentage of wholesale discounts are now based on dealer volume and not reflected on the invoice that dealers can sell cars at invoice all day long and still make a profit. Only the dealer knows what a ‘fair price’ is and it’s their job to try to get more than that.

Similarly on the used car side, only the dealer knows what they paid for their used inventory and what’s its true condition is relative to price.

TrueCar.com has been able to aggregate actual retail prices from a large percentage of dealers and parlay that information into a ‘fair price’ gauge available to buyers, adjusting even for the level of equipment and locale. On the supply side, the dealers wanting to be represented must supply their retail sales information and can also buy valuable information about their competitor’s pricing.

CarFax has become the defacto quality bar in used car sales, reporting prior accidents and repairs. Similarly the pricing portals such as Kelly Blue Book (KBB.com) play a role in setting fair expectations about the value of trade-ins.

- There are plenty of opportunities in B2B

- Expose those APIs to encourage lots of network partners

Although B2C networks have more users, the users in B2B networks often control more resources and therefore can be just as valuable. The same rules about information imbalance between buyers and sellers apply.

Take for example the complex supplier-dominated ecosystems around container shipping, logistics, trading, regulations and tariffs, and ports. Most transportation suppliers are moving to platforms to capture the relationship with their shipping customers by making the transaction transparent and presumably save cost and time.

MassMutual Insurance

Company sponsored defined benefit retirement plans are complex to administer and to optimize. MassMutual and Matrix Financial Solutions partnered on a platform aimed at corporate DB Plan managers offering simplified evaluation and selection of a broader array of investment options, self-service reporting, simplified administration, can generate custom reports on individual plans, and provides customized pension yield curves so that plan sponsors can calculate and report pension liabilities. MassMutual directly serves 2,600 DB plans which may seem like a small network, but one that controls a very large quantity of assets.

- Even traditional product oriented mature businesses can reposition themselves for growth with Platforms.

John Deere

As all elements of agriculture and farming have become more reliant on AI/ML it was a natural extension for John Deere to platformize its My John Deere Operations Center. This is a platform devoted to all things technology in farming from predictive maintenance to GIS/GPS monitoring of crop yields, chemical application, and remote operation of equipment. It’s worth noting that there’s a natural affinity between all things IoT and platform strategy.

Of particular note here is how John Deere opened itself up to other suppliers of gear related to AI/ML based monitoring and control by exposing APIs. This led to one of the most desirable features of any platform strategy in which additional suppliers, managing their own contributions to the network, create a virtuous loop of drawing in more customer-users.

So far John Deere has attracted 114 platform partners that provide data, calibration, or add-on features to Deere’s equipment ranging from weather forecasting, to soil testing, to farm management accounting.

- As platforms evolve they will tend toward micro networks where the value of similarity of users is important.

- There needs to be a defensive awareness of how new platform entrants can disrupt existing platform strategies.

Our final lessons are these:

Creating a platform strategy is not a guaranty of freedom from competition. Since networks are most valuable when users have similar needs, it follows that broader general purpose platforms will be succeeded by more narrowly defined micro platforms where users are more similar. A good example is the LinkedIn platform for sharing of all types of work experiences versus special purpose recruiting platforms focusing on a rare but narrow group of talents like data science.

Creating a platform strategy is not a guaranty of freedom from competition. Since networks are most valuable when users have similar needs, it follows that broader general purpose platforms will be succeeded by more narrowly defined micro platforms where users are more similar. A good example is the LinkedIn platform for sharing of all types of work experiences versus special purpose recruiting platforms focusing on a rare but narrow group of talents like data science.

LinkedIn remains valuable for recruiters looking for a wide variety of skills, but less so for recruiters and job seekers in a narrow specialty.

A platform strategy that optimizes a specific type of value trade is not immune from disruption. Take for example the platforms created by American Express, Visa, and MasterCard bringing shopkeepers and shoppers together.

All of these traditional successful platforms have had to hustle to keep up with burgeoning fintech mobile payment systems that can be owned by mobile phone providers like Apple or ecommerce giants like Alibaba. As awareness of platform strategies becomes mainstream, expect waves of competition. But above all, don’t wait to evaluate and if possible act on your own platform strategy.

Other articles on AI Strategy

AI/ML Lessons for Creating a Platform Strategy – Part 1

A Radical AI Strategy – Platformication

Now that We’ve Got AI What do We do with It?

Capturing the Value of ML/AI – the Challenge of Offensive versus Defensive Data Strategies

The Case for Just Getting Your Feet Wet with AI

The Fourth Way to Practice Data Science – Purpose Built Analytic Modules

From Strategy to Implementation – Planning an AI-First Company

Comparing the Four Major AI Strategies

Comparing AI Strategies – Systems of Intelligence

Comparing AI Strategies – Vertical versus Horizontal.

What Makes a Successful AI Company – Data Dominance

AI Strategies – Incremental and Fundamental Improvements

Other articles by Bill Vorhies

About the author: Bill is Contributing Editor for Data Science Central. Bill is also President & Chief Data Scientist at Data-Magnum and has practiced as a data scientist since 2001. He can be reached at: