According to The Future Health Index 2021, the AI/ML market in healthcare is among the most promising ones. About 40% of healthcare organization leaders in different countries consider the development of the above technologies a major driver for the future sustainability of global health. Let’s talk about the trends and peculiarities of implementing AI/ML-based healthcare software solutions in the US and Europe.

The popularity of AI/ML technologies: survey data

AI/ML is applied for diagnosing, treating, and predicting diseases, as well as for carefully planning the development of individual institutions and the system as a whole. According to research by MarketsandMarkets, ML is considered a leading technology in the healthcare market. There are three regions taking the lead in its development and application: the USA, European countries, and APAC countries.

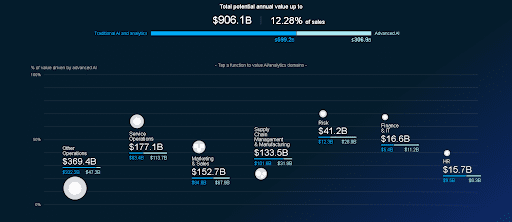

McKinsey estimates that the potential annual volume of the global AI market in healthcare amounts to $906.1 billion. A third of this sum is accounted for by advanced Deep Learning technologies with the highest annual growth in the areas of predictive medicine and operative interventions.

According to McKinsey’s Global AI Survey, in 2019, there was an increase in the use of at least one AI technology in most sectors of the economy. In healthcare, the use of these technologies increased by 58% (growth by 9% per year). Notably, 23% of the technologies used were accounted for by ML and RPA (Robotic Process Automation), and over 30% were the systems for recognizing and generating images and speech.

Data by RELX shows that over 85% of healthcare business leaders in the USA had actively introduced AI into their activities by 2020, while 68% of all respondents were willing to increase their investments in this area.

AI/ML in the US and European markets

How do ML-based products actually enter the US and European healthcare markets? What are the peculiarities in their promotion and the key challenges in the way? We can analyze this based on the dynamics with which medical devices and corresponding software enter the above markets.

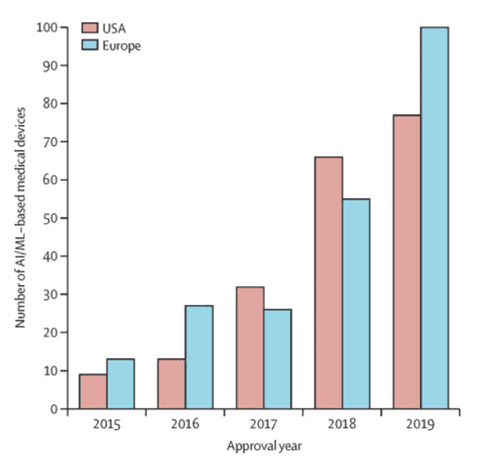

According to data by The Lancet Digital Health, as of March 2020, the number of certified AI/ML-based medical devices in the US and EU markets were 222 and 240 respectively. The data was obtained from both public and non-governmental sources. AI/ML-based medical devices penetrate the market at a different pace, which mostly depends on certification peculiarities of these devices in accordance with national health standards.

The US market

The Food and Drug Administration, an American regulatory body, divides all certified devices into two categories: medical devices (clinical-grade) and general wellness products (consumer-grade). The latter group includes solutions designed to support and promote a healthy lifestyle. The division criterion is whether a device or software aims at diagnosing, treating, or preventing diseases. Solutions belong to one or another class based on the “General Wellness: Policy for Low-Risk Devices” guidance.

If an app or a device is not medical, its entry into the market only depends on the promoting company’s marketing strategy and on compliance with internal tests under warranty obligations. As for all devices identified as medical ones, they require compulsory certification through one of the three approved pathways:

1) the 510(k) pre-market notification/clearance,

2) De Novo classification,

3) pre-market approval (PMA).

As a rule, low-risk devices (Class I) require general control and certification only within the 510(k) pre-market notification. Moderate-risk devices (Classes IIa and IIb) require general and special control within the 510(k) pre-market notification and De Novo pathways. Finally, high-risk devices require compulsory general control and compliance with PMA pathways. The FDA classifies the device based on the scope of its therapeutic functions and impact on patients’ health.

Due to the rather strict FDA requirements, it is more difficult to bring the corresponding AI/ML-based medical devices and apps (SaMD) to the US market than to the European one, but we see the upward trend here as well. Compared to 2015, the number of annually certified AI/ML-based devices in the US market has increased by 8.5 times by 2019 (9 devices vs. 77 devices). In addition, 92% of 222 such devices were certified through the 510 (k) pathway, and only 7% and 1% were certified through the De Novo and PMA pathways respectively.

More than half of all the devices were designed for radiological research, 18% were cardiovascular devices, and 9% were neurological ones. Most of these devices are used strictly by professionals, and only 15% of the devices are for home use.

Nearly 77% of SaMD are delivered to the market by small development companies, and only 23% of them are delivered by large corporations. The manufacturers are mostly US companies, with a small share of developers from France, Sweden, Israel, and the UK (about 20% of devices in total).

The EU market

Adaptation and certification of new SaMD in European countries take less time than in the US. Of the 124 devices certified in both markets, 80 devices (64,5%) were first certified in Europe. This is largely because there is no single regulatory authority or compulsory certification for low-risk devices.

The European Medicines Agency (EMA) is not the equivalent of the FDA; it delegates the right to certify devices to national bodies of European countries, usually by using the Conformité Européene mark (CE). A device is classified as a medical one based on the Council Directive 93/42/EEC for the EU countries and the Therapeutic Products Act for Switzerland. Low-risk devices (Class I) don’t require compulsory certification and their manufacturer is responsible for them. Other classes of devices are certified by Notified Bodies, i.e. designated authorities for CE marking.

Among the 240 devices certified in Europe, only 35% were classified as low-risk devices (Class I), about 54% were marked as Class II, and two devices (1%) were marked as Class III. Compared to the American market, we can see a higher percentage of home-use medical devices (18%) and devices produced by small manufacturers (80% vs 77%). The manufacturers include companies from Belgium, the Netherlands, and Taiwan, but the US development companies are dominant. As in the American market, the devices are used mostly in the three medical areas: radiology, cardiovascular medicine, and neurology; along with that, they are introduced to general hospital use (13%), ophthalmology, gastroenterology (3-5%), and so on.

Addressing the market disparities

In January 2021, the FDA issued the Artificial Intelligence/Machine Learning (AI/ML)-Based Software as a Medical Device (SaMD) Action Plan to improve the dynamics with which SaMD enters the American market. The document provides for:

- the development of an update to the regulatory framework for the specified device category,

- strengthening the development of Good Machine Learning Practice (GMLP) based on such practices as data management, feature extraction, training, interpretability, evaluation, documentation, etc.,

- the support of a patient-centered approach by continuing to host public discussions on the role of transparency of AI/ML-based devices to end-users,

- the support of scientific effort aimed at the development of methodology for evaluating and improving ML algorithms, including for identifying and eliminating bias and for ensuring the robustness and resilience of these algorithms to withstand changing clinical inputs and conditions,

- the promotion of the Real-World Performance pilot projects with a focus on the collection and processing of real-world data together with stakeholders.

Conclusion

Thus, the market of AI/ML-based medical devices is steady and fast-growing, as evidenced by numerous studies and surveys, as well as by the data from certification agencies. The stricter regulatory framework and longer review process, compared to the European market, make it harder for development companies to enter the US market.

Most of the currently used devices in both markets belong to the areas of radiology, cardiovascular medicine, and neurology. In the EU, there is a clear trend towards the increase in the number of devices in other areas – particularly, in hospital medicine.

AI/ML devices are mostly developed by small companies occupying three-quarters of the market. The entry threshold to the American market for foreign companies is quite high. This fact creates good opportunities for custom software development companies that build healthcare software solutions jointly with clinicians.

Governments both in the US and in the EU countries take measures to introduce dedicated national programs to support AI medical businesses, improve certification schemes, introduce the global standards, and attract investment to the industry.