By Ross Parks.

It’s January (now February), which means everyone will be posting his or her predictions for 2016. The blog post predictions I’ve read so far are vague, bold, and sometimes unlikely. However far-fetched these predictions may be, I still enjoy reading them because it makes the reader think about the reasoning behind a prediction, regardless of if the prediction itself holds true within the given timeframe (or if it comes true at all!). Before joining Talavant as a consultant last year, I worked with policy makers in Washington D.C. by compiling and analyzing national data and statistics to help predict future outcomes of healthcare policy. Most recently I worked with a bio tech company in Madison, WI to launch their first medical device. While working there I helped the IT, Sales, and Marketing departments launch data centric initiatives.

Currently, I work as the senior consultant to a large transportation manufacturing plant in Wisconsin. I create databases, reports to automate executive level financial reporting, initiatives to improve on time shipping, and collect leading indicators to predict economic and seasonal effects on sales.

Every day I get to work with large datasets, the bigger the better. I’m also an avid follower of government policy and financial news, so I’ve combined these interests to bring you five predictions for how big data will affect the economy and politics in 2016 and beyond

Prediction 1: 2016 Elections will be won and lost by analytics

My first prediction is that massive data collection efforts and data science will be used during the 2016 presidential election. It will have an impact on the election outcome but will also spark new businesses, business ideas, and put a national spotlight on how big data can be utilized. This will ultimately make big data and data science top of mind when budget-planning meetings are being held in December of 2016.

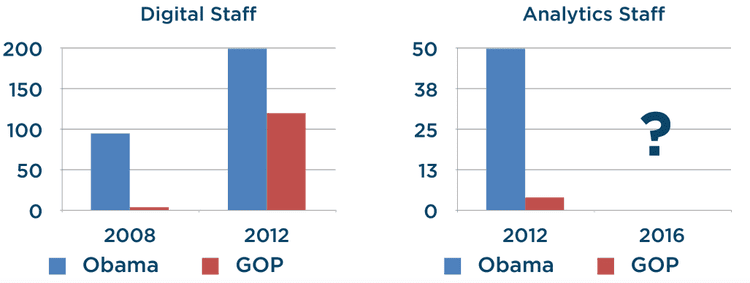

In the 2012 presidential election one political party made a significant investment in analytics while the other party didn’t – the same was true in 2008. Many political Washington insiders believe this investment – or lack of investment – was the difference maker in the election; so don’t be surprised if both political parties throw the war chest at analytics in 2016 to make sure they are not out-smarted.

Source: click here.

Prediction 2: Policy Shaped in “Real-time”

In 2016 we will see more policy shaped by real-time polling that reveals how voters will react to different policy proposals.

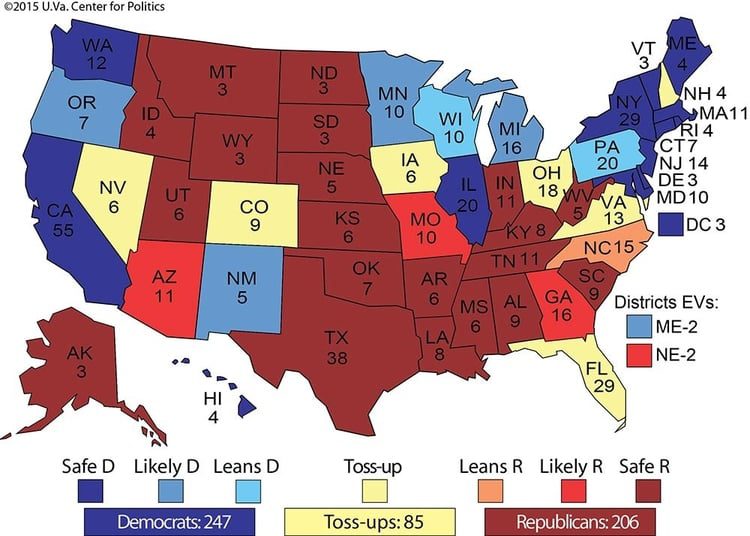

Regardless of political party we will see policymakers using data in a big way to understand their voters and the policy proposals. Candidates have already made huge increases in the amount of polling and data tracking done by campaigns. Once elected, we will see those candidates-turned-policymakers use their data to present more targeted policy proposals and ads towards constituents who may be swing voters. Assuming elected officials at all levels follow through on some of their campaign promises we could see a lot policy geared toward the voters on the fence specifically in swing states with high electoral value. (CO, FL, IA, NC, OH and VA).

Prediction 3: The Tax Burden Gap for Small and Big Businesses Will Widen

There is always a lot of campaign rhetoric around simplifying taxes but the phrase “easier said than done” applies strongly to politicians promising to overhaul business tax laws. This means that tax laws will likely remain complicated for all businesses, big or small, in 2016.

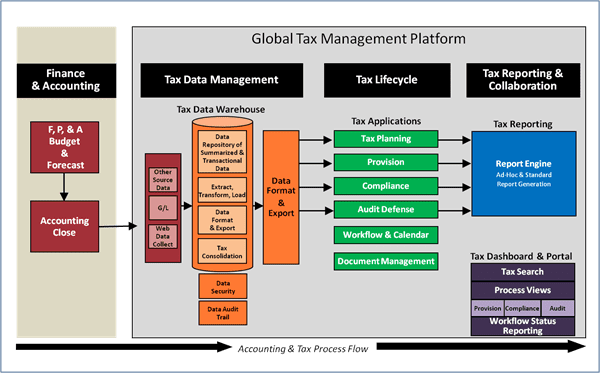

Over the last few years large companies have invested in data warehouse architectures and real time reporting. This investment means that compiling data for an annual tax report is not as labor intensive for a company that is using data warehousing to track their costs and income in real time. This reduces the number of labor hours, and ultimately the burden, required for a large business to comply with their tax obligation. Smaller companies who have not made these investments in data infrastructure will still require the same number of labor hours to comply with their tax reporting. The large companies will find tax reporting simpler with their data warehouses but smaller businesses will not, which makes competing with large businesses that much harder for smaller companies.

Source:click here.

Prediction 4: Acquisitions and IPOs Increase Across Industries

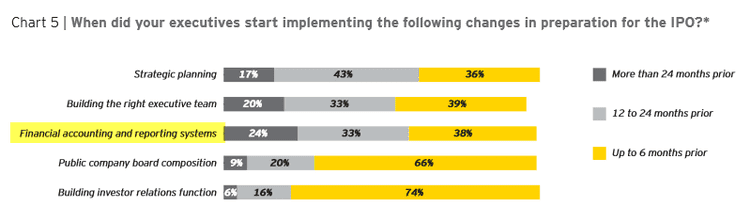

Bigger businesses have the capital to build out business intelligence infrastructure, which gives them a competitive advantage and a better understanding of what smaller businesses are truly worth. An acquisition will also be more profitable if the smaller business has not already invested in BI infrastructure, since the acquiring company could quickly add value by providing access to their BI infrastructure. IPOs will increase as the quarterly disclosure reports to investors become largely automated by BI infrastructure and therefore less of a deterrent to going public.

Source: Click here.

Prediction 5: Hadoop Has a Breakout Year

It has been over 10 years since Doug Cutting and Mike Cafarella created Hadoop. This year will be a breakout year for Hadoop as more executives begin to understand what Hadoop can be used for and big names such as Microsoft integrating Hadoop into SQL Server 2016 with PolyBase. Hadoop could quickly become a hybrid option for many companies with a very large data source who don’t want to get rid of their current data warehouse infrastructure.

Source: click here.

Regardless if these things happen in 2016 or we see more of an effect in the next couple of years I think it is safe to say that as big data and data science techniques are understood by the general public tools and services around them will grow exponentially.

Also see the post on my company’s website, click here.