Market Highlights

On the basis of regional analysis, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. North America region is generating highest market share in Core Banking Solutions Market owing to higher technology implementation. The implementation of core banking solution software by both small and medium enterprises is increasing rapidly. In US region, the implementation of core banking solution software in BFSI sector accounted for highest market share. Due to its capabilities to improve efficiency and better risk management is driving the market in the region. The study also indicates, the high implementation of software in banking service is driving the market in the region. Countries such as US and Canada witnessed large utilization of core banking solutions software in BFSI industry.

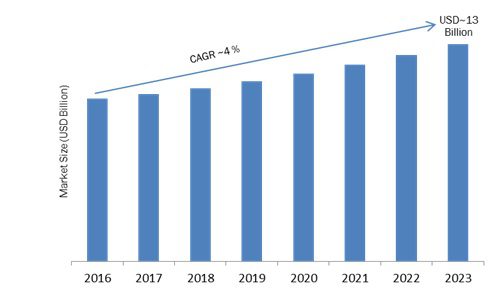

The Core Banking Solutions Market is growing rapidly over 4% of CAGR and is expected to reach at approx. USD 13 billion by the end of forecast period.

Core Banking Solutions Market Players

- Infosys Limited (India)

- HCL Technologies Limited (India)

- Tata Consultancy Services (India)

- Capgemini SE. (France)

- Oracle Financial Services Software Limited (India)

- Temenos Group AG (Switzerland)

- Fidelity National Information Services Inc. (U.S.)

- Misys (U.K.)

- Fiserv, Inc. (U.S.)

- SAP SE (Germany)

Core Banking Solutions Market Segmentation

The core banking solutions market has been segmented on the basis of deployment, solution and service. On basis of solution segment, it consists of account processing platforms, it offers better customer support service. It provides single integrated platform to all the banking channels. It helps organization by providing lower operational cost. It improves efficiency in streamlining process related to customer account management.

Market Research Analysis:

By regional analysis, the market consists of North America, Europe, Asia-Pacific and Rest of the World. North America region is dominating the Core Banking Solutions Market. Asia-Pacific region is one of the prominent players in the market owing to increase utilization of online and mobile banking process. The region witnesses high growth in the market due to emerging economies from countries such as China and India that offers outsourcing services in financial sector that is boosting the market in the region. Increased banking operational efficiency and low cost, leveraging BFSI sector and other benefits associated with it is driving the market in the region. In China, most of the small and medium enterprises are adopting core banking solutions for smooth functioning of money transactions. Europe region is expected to be one of the prominent players owing to presence of core banking software technology in rich banks and financial sector. Also, economies from countries such as Germany, Russia, Spain and Denmark is having high adoption of advanced banking technology in BFSI sector. The study indicates, Europe region is expected to witness high market growth due to high adoption of core banking software technology in IT and banking sector.

Click Here to read more about the report.