The increasing penetration of smartphones across the world, combined with the high-speed & reliable internet connectivity that is now available, has made it possible for financial service providers to enable payments via mobile devices. The mobile payment apps are here to create a world where the cashless economy shines.

E-wallet apps available in current times not only allow users to make payments effortlessly, but they also offer several other financial services i.e. book movie tickets, savings recommendations, buy bonds and securities, et cetera.

Most developed, as well as developing economies are distancing themselves from using physical currency. The developed economies in particular are very committed to this culture shift of utilizing payment technologies. For instance, in the United Kingdom, NFC technology is used to enable contactless payments at bus and tube stations.

The e-wallet trend grew further while the entire world was locked down due to the pandemic. To be precise, many countries across the world realized a decrease of 80% in the use of ATMs. Even the ‘grey’ and ‘black’ markets saw a downfall in the cash usages. A cashless society has many advantages, such as transparent financial status and taxation, crime reduction, convenience, and hygiene.

Indeed, the cashless society is a nearby reality, and the usage of e-wallets and peer-to-peer mobile payment apps will continue to rise. While you might already know what e-wallets are, the peer-to-peer mobile payment might seem a new term to you. Hence, let’s dig further into the rabbit hole of mobile payments:

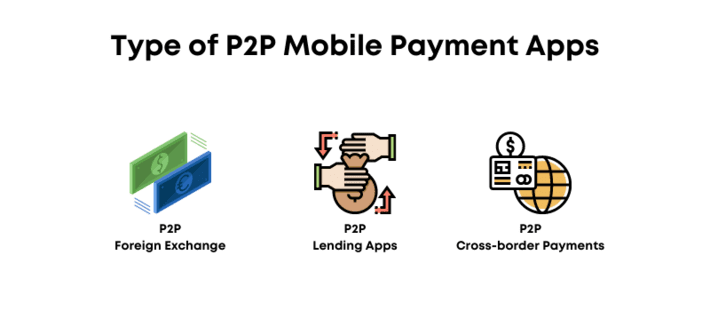

What are P2P Mobile Payment Apps

Peer-to-peer mobile payment apps are designed to enable individuals to make instant payments to friends, relatives, contractors, shopkeepers, and many others. We consider them modern e-wallets if they incorporate features among mobile recharges, movie ticket booking, and also offer virtual credit/debits cards.

The p2p mobile payment apps allow users to transfer funds to the receiver’s wallet or bank account. The wallet to wallet transfers are instantaneous, but if there is any bank included in the transaction, it can take between seconds to days to transfer the funds.

Image Source: Pintrest

4 Business Models for P2P Mobile Payment Apps

Currently the FinTech ecosystem has four business models for p2p mobile payment apps. These are Bank-Centric, Standalone Payment Services, Social or Messaging Platforms, and Mobile Device or OS Manufacturers. Let’s find out more about the top three in detail:

- Bank-centric p2p mobile payment apps

Apps like Dwolla, Zelle, clearXchange are built on the bank-centric business model. Instead of storing money into the app, these p2p mobile payment apps directly draw money from the user’s bank account and make payment to the merchants.

- Standalone payment services

The most popular examples of standalone payment services are Ant financial, PayPal, Vodafone M-Pesa, Airfox, and Square Cash. Many countries worldwide allow these standalone payment services providers to officially mediate in financial transactions. This allows standalone payment service providers to offer both online and in-person p2p and c2b payments.

Standalone mobile payment apps often have a digital wallet that enables seamless payments, without requiring users to draw money from bank accounts. Considering low penetration of conventional banking services in many underdeveloped and developing nations, standalone payment services are the best way to bank the unbanked.

- Social and messaging platforms

Payment platforms like Square Cash, Snapchat, G Pay, WeChat, Facebook Messenger, and the most popular one, Whatsapp operate under this business model. As social platforms have gained popularity among the majority of the population worldwide, social platforms have seen a huge potential in introducing payment features into their social apps.

What made them Successful? – PayPal and Alipay

The pioneer and #1 – PayPal

Elon Musk was very quick to anticipate and respond to the potential of money transfer through the internet. Earlier, Elon Musk founded x.com, an online bank, which later bought PayPal and gained more board members who cumulatively paved the way for a successful online payment industry.

The most crucial success factor for PayPal was its timely acquisition of rising companies in its ecosystem. They acquired Braintree, Venmo, Xoom, Modest, VeriSign, and Paydiant, and also tied up with MasterCard, which established them as a successful player in the online payment industry.

PayPal’s critical success factors were:

- Blue ocean business strategy

- Early anticipation of internet potential

- Timely acquisition and partnership within the ecosystem

- Harnessing network intelligence

- Focusing on standing as a credible business on an international level

The critical success factors that paved success for Paypal are:

Alipay: Chinese PayPal… quite better

Recently, the global FinTech market was in shock when the world’s biggest IPO (potentially $34.5 billion) got canceled. Alipay is a subsidiary of the same company, Ant Group. Although the USA may brag about its success in financial technology implementations, China has proved to be the largest market for P2P mobile payments.

During the first ten months of 2020, Mobile payment transactions in China reached a record $12.8 trillion, which clearly is far greater than the $49.3 billion of transactions for the USA in the same period.

The following are the success factors for Alipay:

Good Artists Copy – Alipay had the advantage of Alibaba’s ecosystem and Ant Group’s financial core. The mobile payment solution was launched in 2004 to provide online payment and escrow services in the market. It all began with a similar feature and business model as PayPal, but later on, Alipay expanded its reach and became a one-stop solution for online payments.

Leveraged versatility – Alipay provided the escrow service almost free of cost. With more and more businesses utilizing their escrow services (as they were very inexpensive), Alipay started having a bulk of funds in their working capital. Alipay utilized these billions of dollars to offer credit and money-market funds to earn interest. All of this was supported by the sister companies – Ant Cash Now and Ant Credit Pay.